[ad_1]

Janet Leighton spends a 3rd of her working week talking to staff about their cash worries.

A part of her mission at Timpson, the UK retailer greatest recognized for its shoe restore and key reducing companies, is to make that stress disappear. “I’m not a certified monetary adviser,” she says, “however I understand how to make budgets and I do know my colleagues.”

Leighton is the corporate’s Director of Happiness — a seemingly frivolous title for a significant function she’s held since 2018. She says she just lately helped one employees member supply and buy a automotive. Timpson paid the vendor £1,990 and Leighton knocked up a manageable compensation plan for the worker unfold over 12 months. “We don’t need them to battle and go to a mortgage shark or a payday lender,” she explains.

“If folks have gotten issues, we need to know,” says Leighton, including that staff inevitably carry monetary considerations into the office. “We would like folks to provide glorious customer support, so we have to allow them to try this. Finally, we’re a business enterprise. If we assist our colleagues, we all know this can come again to us tenfold.”

Along with the £450,000 in interest-free loans Timpson has collectively granted to its 5,000 employees — with the typical particular person mortgage someplace between £500-£1,000 — it additionally offers away at the least £50,000 in money presents a yr. When one worker’s grandmother handed away, he was on the hook along with his siblings to cowl funeral prices. Timpson says it supplied his share. The corporate additionally rewards employees financially for all times milestones — from quitting smoking to getting married and studying methods to drive — and pays the associated tax invoice.

Timpson, given its historical past as a household firm and the comparatively low wages of a lot of its staff (its common store flooring employee earns round £20,000-£23,000 a yr), has a paternalistic tradition. Its method to the monetary wellbeing of staff has, till now, been comparatively distinctive.

However the variety of employers within the UK getting extra concerned within the monetary affairs of their employees is rising. Corporations are usually not solely stepping in to barter higher charges on cell phone tariffs and power payments for all the workforce, but additionally managing a person’s private cash woes by issuing loans or developing with plans to repay bank card debt.

The identical is occurring within the US. Based on a recent Bank of America report, 97 per cent of US employers surveyed really feel accountable for worker monetary wellness, up from 41 per cent in 2013.

Previously, if an worker was in hassle, it could land on the desk of the human sources group. At this time, monetary wellbeing is on the agenda in company boardrooms.

The pandemic accelerated this pattern as managers had been pressured to confront the physical and mental health concerns of workers, paying nearer consideration to the non-public lives of their staff than ever earlier than. Offering entry to on-line train courses and meditation apps, work-life stability teaching and workshops on methods to make parenting simpler had been a couple of new perks on provide in lots of corporations.

That blurring of personal {and professional} boundaries has cemented a outstanding cultural shift. Employees are extra comfy discussing private points and political matters — from in poor health well being and childcare troubles to local weather change to racial injustice — with colleagues and managers.

The significance of monetary wellbeing — in some methods probably the most delicate space in somebody’s private life — has solely grown as the price of residing disaster bites. Inflation is rising greater than wages. On a regular basis purchases including food and fuel have gotten extra unaffordable. To make ends meet, even these in full-time employment are turning to wage advances, overdraft extensions, payday loans, family and friends and bank card debt.

A current report from the Cash and Pensions Service exhibits there are greater than 11mn working-age folks within the UK who’re deemed “financially struggling” or “financially squeezed”. Round 14 per cent haven’t any financial savings in any respect and 19 per cent have financial savings of lower than £500.

“Many of those persons are juggling the challenges of a busy working life, variable revenue and a younger household,” says MaPS, a public physique sponsored by the UK authorities’s Division of Work and Pensions. That is precarious as two-thirds of adults obtain surprising payments yearly. “The breakdown of a automotive or home equipment might imply calling on pricey, short-term credit score. It might even tilt folks right into a debt disaster,” the report warns.

If staff are routinely struggling to make ends meet, an apparent repair is perhaps to easily pay them extra. Executives, nonetheless, are dealing with their very own monetary stress and are discovering methods to ease the financial ache felt by staff if they’re unable, or unwilling, to supply widespread pay will increase.

A brand new-look advantages bundle

Providing a extra considerate advantages bundle is how Phil Bentley, chief government of Mitie, a services administration firm that employs 68,000 largely lower-income staff within the UK, says it helps its employees.

“On low pay, folks battle to handle family budgets. We have now all the time been pushing for greater pay for our folks. However it’s as much as our purchasers [that contract our services] to conform to it. If we will’t [raise] pay, then now we have to do it through the advantages bundle,” says Bentley. “We have now to be smarter.”

Mitie has launched a £10mn “winter assist” bundle to assist the corporate’s decrease paid colleagues. As well as, it says, it has given out retail present vouchers and one-off price of residing funds.

Suggestions of pensions advisers, employees reductions for retailers, subsidised gymnasium membership, bicycle loans and practice season ticket loans was once common perks. Now corporations are going additional by offering entry to 3rd events that may assist restructure debt, present sizeable loans or entry to earnings in faster time, moderately than leaving staff beholden to plain cost cycles.

Within the UK, corporations are reaching this by partnering with fintechs corresponding to Wage Finance or Wagestream. Within the US, monetary wellness instruments and apps together with DailyPay and PayActiv have been round for longer.

Mitie launched a loans programme via Wage Finance in December 2017. Since then, 10,000 loans have been taken out, with a complete worth of £25mn. Colleagues have saved round £3mn in curiosity by utilizing the scheme, the corporate says.

“The price of residing disaster . . . isn’t new,” says Asesh Sarkar, chief government of Wage Finance. Backed by Virgin Cash within the UK, Wage Finance permits financial savings plans and facilitates private loans, repayments for that are robotically taken out of an worker’s pay packet. Grocery store chain Tesco, one of many UK’s greatest personal sector employers, has introduced it’s partnering with the corporate.

“Individuals don’t save,” continues Sarkar. “They accumulate enormous ranges of debt and millennials are far worse off than their mother and father. It’s extra acute now, however it’s not new. It’s develop into normalised. So employers at the moment are seeking to do one thing about it.”

“Most UK adults are usually not financially literate,” Sarkar provides. “Earlier than, you’ll say it is best to all the time have three months’ wage saved. It’s now a free for all. Nobody is aware of what to goal for.”

However whereas some people are spending carelessly, a much bigger difficulty is that the chances are stacked in opposition to those that don’t. Sarkar has specific considerations about purchase now, pay later agreements, which “create routine ranges of debt”. He sees this for example of how the financial system perpetuates a system that works in opposition to the bottom earners who’re seen because the riskiest debtors by banks and are charged lots of of kilos extra per yr for primary companies.

“In finance, it’s normalised that the poorest in society pay extra for merchandise,” Sarkar says, including this is able to be thought of unthinkable in different sectors corresponding to retail. Wage Finance is quickly hoping to launch mortgage merchandise, utilizing its lobbying energy to safe higher charges for these almost definitely to get the worst offers from conventional banks.

However these direct and oblique transactions are complicating the character of relationships between employers and their employees. Employees are sometimes gifting away way more details about themselves to their bosses. It might even be an uncomfortable state of affairs to owe cash to your employer.

Caroline Siarkiewicz, chief government of the Cash and Pensions Service, says whereas it was good that staff had been extra vocal about cash considerations and that employers had been eager to assist, the dynamic carries some threat. As a employee, she says, “you’ll be admitting you want assist”.

“Employers additionally see that you simply might need made some unhealthy choices and there’s a worry of being judged,” says Siarkiewicz, including there is perhaps a notion that it might affect promotions, pay rises and broader office development.

However additionally it is a gray space for employers, with executives more and more asking the place the restrict is for company involvement within the lives of particular person staff.

There are dangers too. Corporations might tackle liabilities they by no means envisioned, for instance if an worker defaults on a mortgage. There might also be adversarial results of selecting to assist one worker financially over one other, risking accusations of favouritism. There are additionally tax implications for handing out money advantages above a certain quantity.

Establishing boundaries

One resolution appears to be establishing a partnership with an out of doors organisation. Workers can search assist with out revealing particulars to their employer. But, this can also develop into ethically murky.

By passing on contact particulars a couple of third occasion service, employers are additionally unwittingly advocating for a corporation that might not be regulated by the Monetary Conduct Authority, like a financial institution can be. They’re additionally not directly funnelling enterprise to the monetary establishments that assist these third occasion corporations.

“If, because the employer, you usher in an impartial dealer, they don’t seem to be terribly impartial. The job of an organization is to offer easy accessibility to info, however with out endorsing it”, says Octavius Black, chief government of office coaching supplier MindGym.

He sees these efforts as an untested space with potential downsides ought to an organization be blamed for one thing going unsuitable within the monetary affairs of a member of employees, or the entities offering the companies. “Psychologically, an worker may really feel their employer is liable even when, legally, they don’t seem to be,” he provides.

Whereas their intentions could also be good, corporations are opening themselves as much as accusations of making the most of their very own staff. Timpson, for instance, prices an administration price of 5 per cent per mortgage transaction. Whereas that is far lower than the typical annual share rate of interest of as much as 1,500 per cent charged by payday lenders, or greater than 20 per cent APR for a typical bank card, it’s nonetheless a way via which an employer stands to realize.

However there may be one other college of thought that argues doing nothing is now not an choice. Employees at the moment face a world the place they’ve much less job stability and extra particular person threat round unemployment, illness and longer retirements as folks dwell longer.

Economist Minouche Shafik argues in a paper, primarily based on her e-book What We Owe Every Different: A New Social Contract, that the rise of momentary contracts, part-time preparations and the so-called gig financial system means “staff more and more carry the danger of what number of hours they’ll work, holding their abilities related, supporting themselves in the event that they get sick, and securing their revenue for when they’re outdated.”

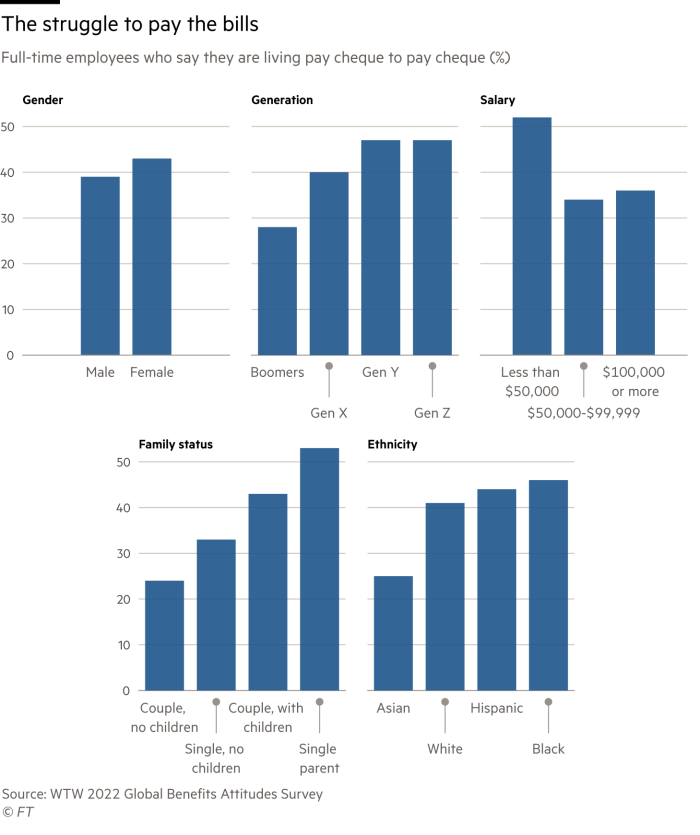

In an effort to obtain an inexpensive way of life, many staff find yourself taking over debt, however then haven’t any hope of incomes sufficient to pay it off. Even those that are comparatively properly off are in a precarious state of affairs. Practically 40 per cent of US staff incomes over $100,000, surveyed by consulting agency Willis Towers Watson, reside pay cheque to pay cheque. That is twice as many because the quantity in 2019.

With governments tightening their belts and banks more and more threat averse — declining two out of each three mortgage purposes, significantly these from decrease earners and shift staff with unpredictable incomes — employers are within the line of sight.

“They’re probably the most vital monetary establishment in your life. They’re supplying you with cash when everybody else is taking your cash,” says Peter Briffett, chief government of Wagestream, a charity-backed fintech.

Wagestream doesn’t difficulty loans. As an alternative, armed with employer knowledge on work schedules and pay per shift taken, its app permits full-time employees and informal staff to have actual time visibility on earnings moderately than ready till the top of the month to see if the numbers add up.

It prices a £1.75 flat price per transaction, like an ATM cost, ought to staff choose to fast-track as much as 30 per cent of their month-to-month pay. In addition they cost a platform price to employers, corresponding to NHS Trusts and retailers. “We see an increasing number of employers paying. It’s taken some time for us to show that individuals do extra work and they’re simpler to retain [once they have this access to their data] . . . the propensity for employers to pay is now greater.”

Diana, who requested to withhold her final title, works at retailer The White Firm and makes use of the Wagestream app to entry her subsequent month’s earnings if she is falling quick. She hopes to keep away from the monetary turmoil she confronted when her earlier marriage collapsed. Again then, she was pressured to go to payday lenders, enhance her bank card restrict and make excessive rate of interest funds. “It precipitated nice stress, despair and sleepless nights as a result of I used to be frightened concerning the cash. I don’t need to be in that place once more,” she says.

These like Diana are usually not saving and may spend extra continuously, in accordance with academics. However they’re staying within the black; avoiding late invoice funds, financial institution overdraft charges and different prices that may set off a debt spiral.

For companies, there are business pursuits to guard. Monetary stress prices corporations vastly within the type of absenteeism and misplaced productiveness as staff cope with private cash points whereas on the clock. Those that are financially harassed are additionally extra prone to search for jobs elsewhere, costing corporations extra in recruitment and coaching at a time of power abilities scarcity.

“Each business appears to be in need of folks,” says Rupal Kantaria at administration consultancy Oliver Wyman. “If an organization is determined to maintain expertise and you’ll assist an worker from descending into some adverse monetary spiral, that’s good for everybody.”

“The worker may even have a larger sense of belonging to an organisation and loyalty . . . It is a second of necessity, however it’s additionally a second of alternative for employers.”

Pictures by Anna Gordon and Jon Tremendous for the FT; Jason Alden/Bloomberg and Mitie

[ad_2]

Source link