[ad_1]

Whereas it’s extensively reported that tons of of thousands and thousands of {dollars} in Ethereum-based tokens have been siphoned from the FTX pockets after the corporate filed for chapter on Nov. 11, 2022, one other $333 million value of FTX-related bitcoins in some way vanished as effectively. At one level, FTX held $3.3 billion value of bitcoins throughout its heyday, however by Nov. 7, 2022, the trade held 0.25 bitcoin.

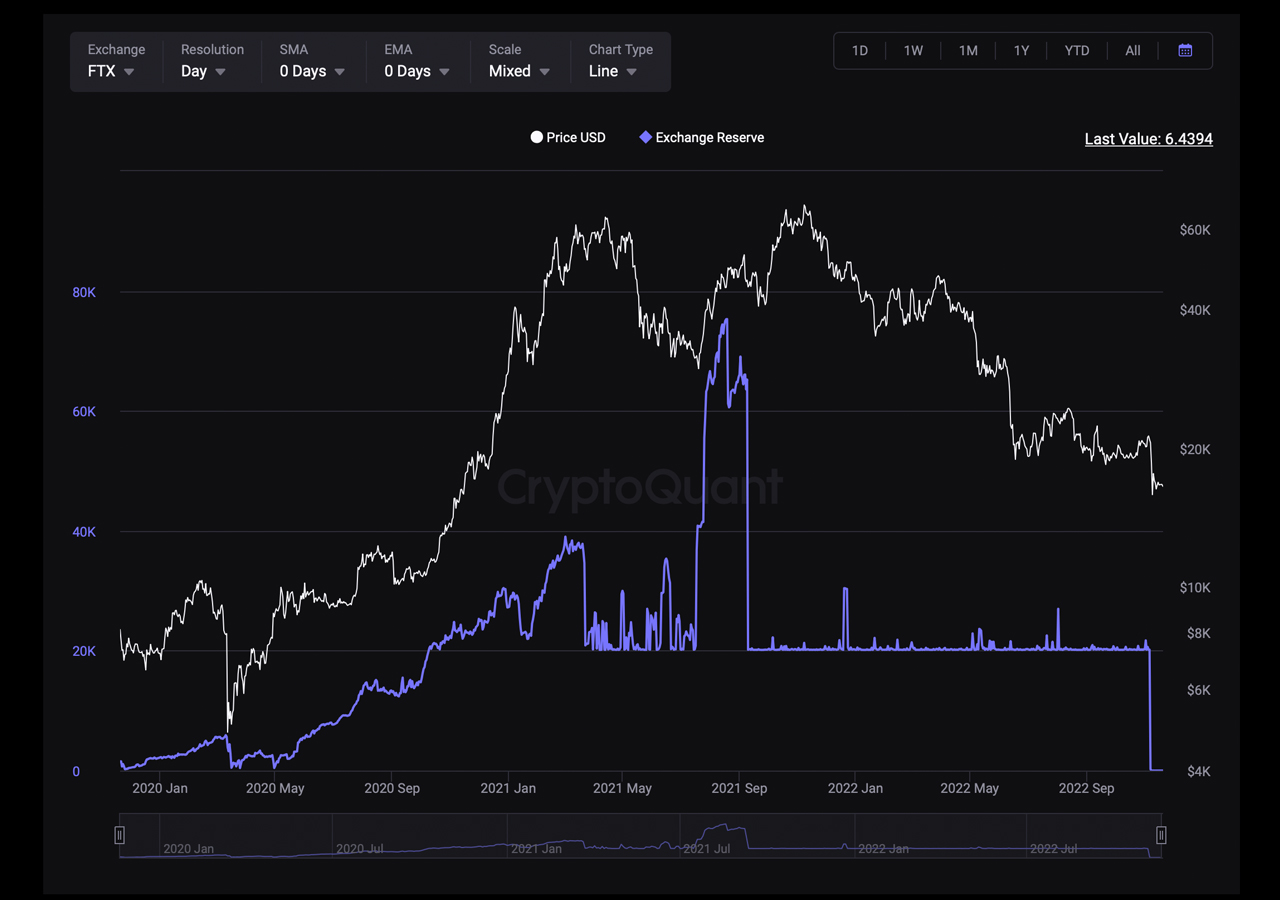

5 Days Earlier than FTX Filed for Chapter, 20,176 Bitcoin Left the Alternate in Much less Than 24 Hours

After Binance’s CEO Changpeng Zhao (CZ) told the general public that Binance can be dumping all of its FTT tokens, individuals instantly began to observe FTX’s response. Along with watching FTX’s response to CZ’s statements, individuals began to eye the beleaguered trade’s crypto balances.

Quite a lot of individuals are watching the Ethereum-based addresses that siphoned funds from the trade the identical day it filed for chapter safety. Nonetheless, FTX additionally held at the very least 20,176.84 bitcoin (BTC) on Nov. 5, 2022. But the next day, FTX’s BTC reserves dropped to 220.26 bitcoin. By Nov. 7, 2022, knowledge revealed the trade solely held 0.25 bitcoin because it was all transferred effectively earlier than the agency’s bankruptcy filing.

Final 12 months, when FTX was a high trade when it comes to international crypto commerce quantity, cryptoquant.com data exhibits the buying and selling platform held 75,303 BTC, and bitcoin was exchanging palms for round $46K per unit. At that trade price in mid-April 2021, the stash of 75K + bitcoin was value roughly 3.3 billion nominal U.S. {dollars}.

By mid-September 2021, FTX’s bitcoin reserves dropped all the way down to the 20,000 vary and remained that method for effectively over a 12 months. An archived snapshot recorded on Could 8, 2022, signifies that coinglass.com knowledge had as soon as proven FTX was the eleventh largest trade when it comes to BTC reserves.

On that day, FTX held 20,048.43 bitcoin in keeping with coinglass.com’s knowledge. Coinglass now locations FTX within the 18th place because it exhibits the trade holds 7.03 BTC. Cryptoquant.com’s metrics point out that FTX’s pockets holds roughly 7 BTC on Nov. 19, 2022. The 20,176.84 BTC is value round $333 million however when it was transferred the funds have been value about $409 million.

The 20,176.84 BTC leaving FTX was reported on by way of Twitter and a couple of crypto media publications. Furthermore, FTX’s bitcoins vanished earlier than CZ told the general public Binance would purchase FTX after which later revealed Binance backed out of the deal over due diligence.

Whereas the proof-of-reserves idea has been gaining traction, a lot of trade addresses have been already identified to the general public. FTX’s BTC reserve stash was recorded by a lot of onchain knowledge websites together with cryptoquant.com, glassnode.com, and coinglass.com.

What do you consider the 20,000 bitcoins that vanished from FTX on Nov. 7, 2022? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any harm or loss prompted or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link