[ad_1]

This month, gold has outperformed bitcoin after crypto markets shuddered from the current FTX collapse, and the valuable yellow steel climbed 6.12% because the first of November. The U.S. housing market has proven weaknesses and October’s U.S. inflation price was decrease than anticipated. Analysts consider these financial traits contributed to pushing gold’s worth up by 3.81% towards the buck on Nov. 10, 2022, after the U.S. Bureau of Labor Statistics revealed October’s client worth index (CPI).

So Far Gold’s Market Efficiency in November Has Outpaced Bitcoin’s

Bitcoin has seen higher days because the main crypto asset is down greater than 18% decrease than it was through the first of November. A substantial amount of the crypto asset’s USD losses might be contributed to the FTX collapse and the chaotic aftermath that adopted.

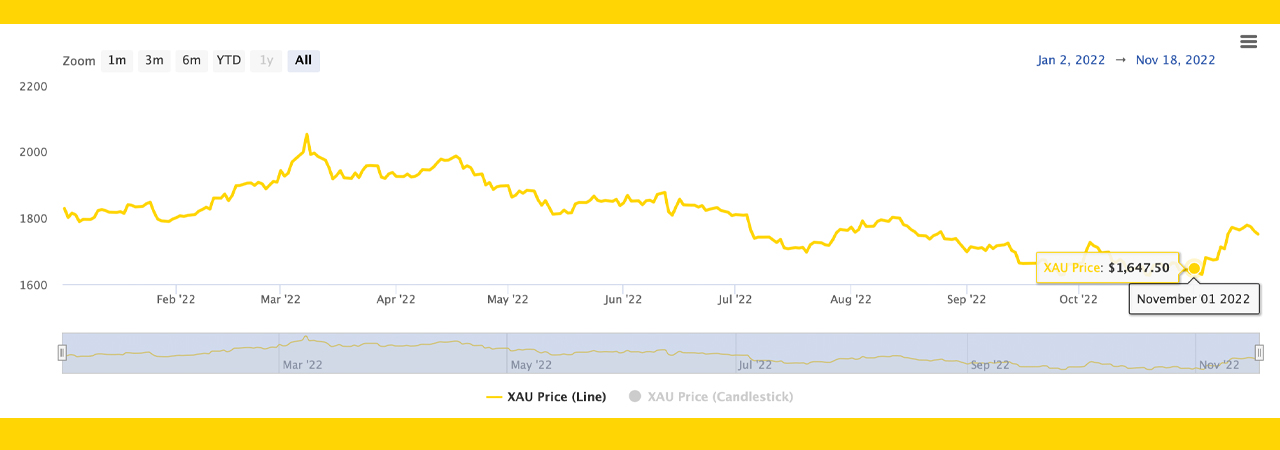

An oz. of gold, alternatively, has risen 6.12% greater than it was buying and selling for on Nov. 1, 2022. On that day, a troy ounce of .999 fantastic gold’s spot worth was 1,647.50 nominal U.S. {dollars}. In the present day, the worth of an oz of .999 fantastic gold is roughly $1,748.49 per unit.

Analysts, gold bugs, and economists are attributing a few of gold’s success through the previous two weeks to the decline in U.S. actual property gross sales. The Nationwide Affiliation of Realtors (NAR) reported on Friday that “existing-home gross sales slumped 5.9% in October.”

“Present-home gross sales light for the ninth month in a row to a seasonally adjusted annual price of 4.43 million. Gross sales fell 5.9% from September and 28.4% from one yr in the past,” the NAR report particulars. The NAR research additional attributes the falling house costs to the Fed’s aggressive price hikes which have elevated the 30-year lending price an awesome deal this yr.

Most of gold’s rise began on Nov. 1, 2022, and it jumped even greater after the U.S. Bureau of Labor Statistics published October’s client worth index (CPI). The decrease inflation price pushed the worth of gold up 3.81% towards the U.S. greenback between Nov. 10 via Nov. 13, 2022.

The report additionally helped bitcoin (BTC) to some extent, because the FTX collapse impact on crypto markets might have been worse if the inflation price was greater. BTC’s one-hour candle after the CPI report revealed jumped an awesome deal greater.

On Nov. 10, gold’s worth per ounce was coasting alongside at $1,706 per unit and by Nov. 13, 2022, it was buying and selling for $1,771 an oz. Frank Cholly, the RJO Futures senior market strategist, told Kitco Information that gold might have run up too quick and the valuable steel is just taking a breather.

“Gold received near $1,800. And now the market is seeing some revenue taking. It does look like rolling over. I’m not able to get bearish but. We’re taking a breather,” Cholly defined on Friday. Nevertheless, there’s a level the place Cholly might get bearish because the RJO Futures senior market strategist remarked:

If gold closes below $1,750, I’d begin to get bearish — At $1,725, issues flip bitter for gold.

Very like bitcoin proponents betting on the Bitcoin halving occasion to bolster BTC’s costs, gold bugs assume the worth of gold will likely be a lot greater over the following eight years. Merchants at primexbt.com believe gold will attain $4,721 per ounce by 2024 and by 2030 the merchants predict gold will attain $8,732 per ounce.

What do you concentrate on gold’s market efficiency up to now this month? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss brought about or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link

Get a bonus for sign up

Get a bonus for sign up