[ad_1]

An evaluation of the FTX and Alameda Analysis collapse has been revealed by the blockchain and crypto analytics agency Nansen and the report notes that the Terra stablecoin collapse, and the liquidity crunch that ensued, possible began the domino impact that led to the corporate’s implosion. The research from Nansen additional particulars that “FTX and Alameda have had shut ties for the reason that very starting.”

Report Exhibits Terra LUNA Collapse and Intermingled Relationships Could Have Initiated FTX’s and Alameda’s Demise

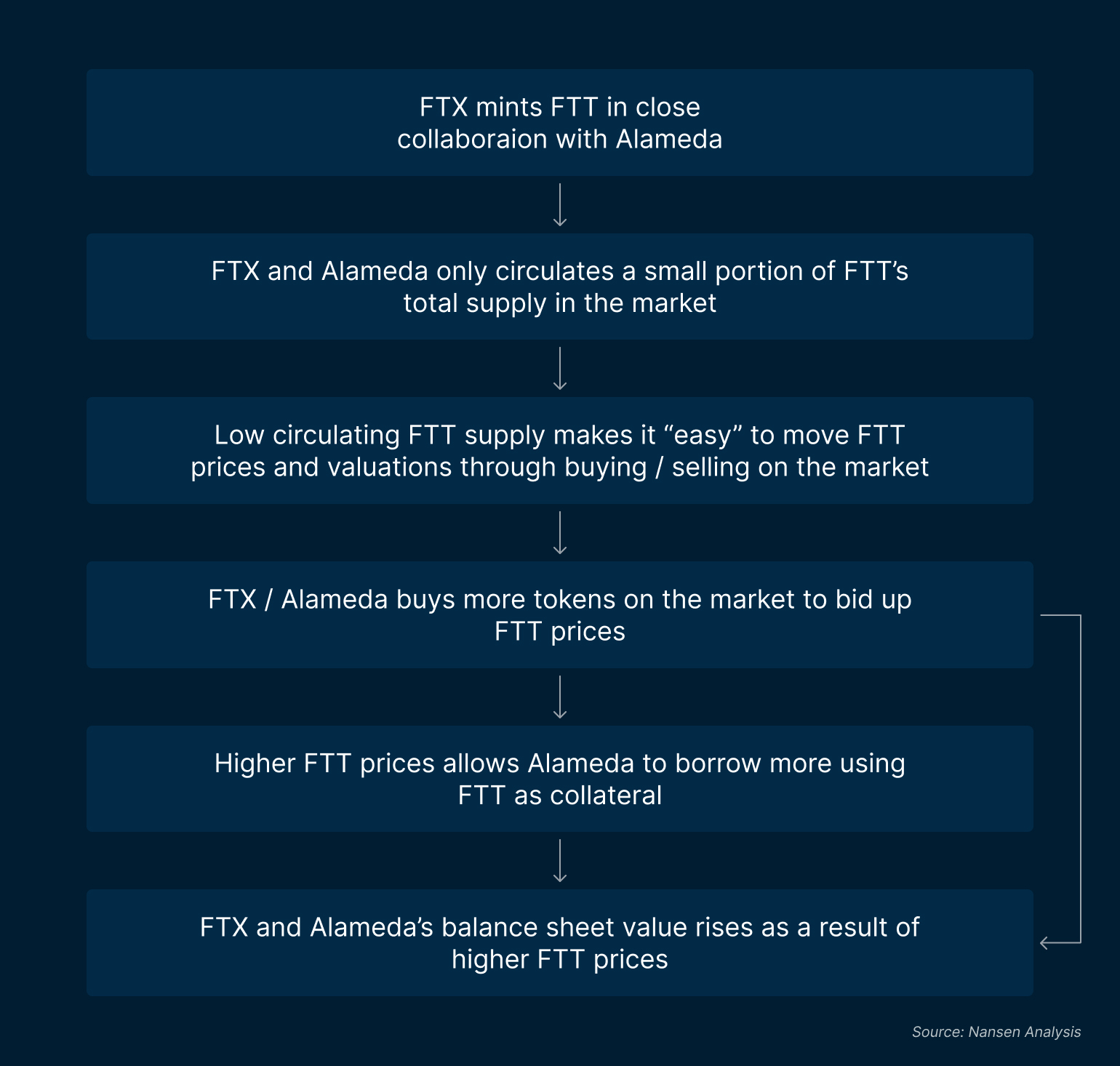

On Nov. 17, 2022, 5 researchers from the Nansen group revealed a blockchain evaluation and complete have a look at the “The Collapse of Alameda and FTX.” The report notes that FTX and Alameda had “shut ties,” and blockchain data verify this truth. FTX’s and Alameda’s rise to the highest began with the FTT token launch and the “two of them shared nearly all of the overall FTT provide which didn’t actually enter into circulation,” Nansen researchers detailed.

FTX and FTT’s meteoric scaling led to Alameda’s swelling steadiness sheet which “was possible used as collateral by Alameda to borrow in opposition to.” Nansen researchers element that if the borrowed funds had been leveraged to make illiquid investments, then “FTT would grow to be a central weak spot for Alameda.” Nansen researchers say weaknesses started to point out when Terra’s once-stable coin UST depegged and triggered an enormous liquidity crunch. This led to the collapse of crypto hedge fund Three Arrows Capital (3AC) and crypto lender Celsius.

Whereas it’s not related to Nansen’s report, 3AC co-founder Kyle Davies said in a current interview that each FTX and Alameda Analysis “colluded to commerce in opposition to purchasers.” Davies implied that FTX and Alameda had been stop hunting his crypto hedge fund. After the contagion impact from Celsius and 3AC, Nansen’s report says “Alameda would have wanted liquidity from a supply that might nonetheless be prepared to offer out a mortgage in opposition to their current collateral.”

Nansen particulars that Alameda transferred $3 billion value of FTT on the FTX trade and most of these funds remained on FTX till the collapse. “Proof of the particular mortgage from FTX to Alameda just isn’t immediately seen on-chain, probably as a result of inherent nature of CEXs which can have obfuscated clear [onchain] traces,” Nansen researchers admit. Nonetheless, outflows and a Bankman-Fried Reuters interview counsel to Nansen researchers that FTT collateral could have been used to safe loans.

“Based mostly on the info, the overall $4b FTT outflows from Alameda to FTX in June and July may probably have been the availability of elements of the collateral that was used to safe the loans (value at the least $4b) in Could / June that was revealed by a number of folks near Bankman-Fried in a Reuters interview,” Nansen’s research discloses. The report concludes that the Coindesk steadiness sheet report “uncovered considerations concerning Alameda’s steadiness sheet” which lastly led to the “back-and-forth battle between the CEOs of Binance and FTX.”

“[The incidents] triggered a ripple impact on market members, Binance owned a big FTT place,” Nansen researchers famous. “From this level on, the intermingled relationship between Alameda and FTX grew to become extra troubling, on condition that buyer funds had been additionally within the equation. Alameda was on the stage the place survival was its chosen precedence, and if one entity collapses, extra hassle may begin brewing for FTX.” The report concludes:

Given how intertwined these entities had been set as much as function, together with the over-leverage of collateral, our autopsy [onchain] evaluation hints that the eventual collapse of Alameda (and the ensuing impression on FTX) was, maybe, inevitable.

You possibly can learn Nansen’s FTX and Alameda report in its entirety here.

What do you concentrate on Nansen’s complete report in regards to the collapse of Alameda and FTX? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Editorial picture credit score: Nansen Analysis, Maurice NORBERT / Shutterstock.com

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link