[ad_1]

The UK’s charge of inflation hit a recent 41-year excessive in October, accelerating to 11.1 per cent on the again of rising vitality and meals costs.

The Workplace for Nationwide Statistics mentioned the speed rose from 10.1 per cent in September, placing inflation at its highest degree since October 1981. Economists polled by Reuters had anticipated a charge of 10.7 per cent.

The surprisingly excessive rise in costs in October presents a troublesome backdrop for chancellor Jeremy Hunt’s Autumn Assertion on Thursday and suggests the Financial institution of England should increase rates of interest additional to carry inflation all the way down to its 2 per cent goal.

In October, the sharp rise in the price of dwelling was brought on by larger gasoline, electrical energy and meals costs regardless of the federal government’s vitality worth assure, which capped payments for gasoline and electrical energy at £2,500 for a family with common utilization of each fuels.

Meals worth inflation rose sharply to 16.5 per cent on an annual foundation, the best for 45 years, based on the ONS.

Grant Fitzner, chief ONS economist, mentioned: “Over the previous yr, gasoline costs have climbed almost 130 per cent whereas electrical energy has risen by round 66 per cent.”

The one comparatively shiny spot within the figures was that core inflation, excluding meals and vitality, held regular at 6.5 per cent in October, the identical charge as in September. Economists had been hoping, nevertheless, this measure would dip to six.4 per cent in October.

Hunt blamed Russia’s conflict in Ukraine for the deepening value of dwelling disaster, however pledged to take “robust however mandatory selections on tax and spending” within the Autumn Assertion to assist carry inflation down.

“We can not have long-term, sustainable development with excessive inflation. Tomorrow I’ll set out a plan to get debt falling, ship stability, and drive down inflation whereas defending probably the most weak,” Hunt mentioned.

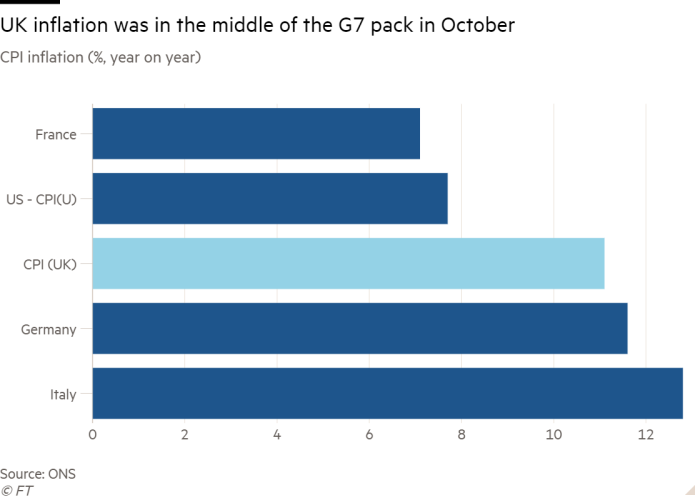

The UK’s charge of inflation was much like many different G7 nations and is not the best — Italy’s charge hit 12.8 per cent in October.

Economists thought the UK charge might need peaked and will fall within the months forward, though they warned that any decline was more likely to be gradual.

Yael Selfin, chief economist at KPMG UK, mentioned annual worth rises had most likely hit a peak.

“The mixture of weaker development and the waning influence of worldwide provide shocks might result in easing worth pressures. However, inflation might keep above the Financial institution of England’s 2 per goal till the center of 2024,” she mentioned.

Mike Bell, international market strategist at JPMorgan Asset Administration, mentioned the rise in inflation to high 11 per cent didn’t tally with the BoE’s message earlier this month that rates of interest wanted to rise solely modestly farther from the present 3 per cent charge to carry inflation down.

“Till it’s clear weaker exercise is beginning to weigh on wage calls for, we imagine the Financial institution of England should preserve mountain climbing. We see UK charges peaking at 4.5 per cent,” he mentioned.

The primary moderating pressure within the inflation figures was a decline in motor gas inflation in October, the place costs have been 22.2 per cent larger than a yr earlier, down from an inflation charge of 26.5 per cent in September.

However the statistical company famous that petrol costs fell 2.9p a litre in the course of the month whereas diesel costs rose by 2.3p a litre. This extremely uncommon divergence, it mentioned, was the most important on document and speculated that “this might be a consequence of a surge in international demand for diesel for electrical energy manufacturing”.

[ad_2]

Source link