[ad_1]

Later this month, Berman Auto Group will host what has grow to be a uncommon prevalence at a automobile dealership up to now two years: a gross sales occasion.

The corporate in April purchased about 150 automobiles when it opened one other web site in metropolitan Chicago, pegging the costs to a market benchmark that had skyrocketed since 2020. Vice-president Ross Berman then watched helplessly when used automobile costs started to fall, consuming into the seller’s revenue margins for the automobiles he had not but offered.

“They’re an indication to me of how a lot has modified over the previous few months,” Berman stated. For Black Friday, the procuring bonanza after the Thanksgiving vacation, he’s providing zero per cent financing. “We wish to promote these vehicles.”

Rising used automobile costs helped drive the worst US inflation in a technology. Authorities statistics present costs are 49 per cent increased than in June 2020 within the early days of the pandemic.

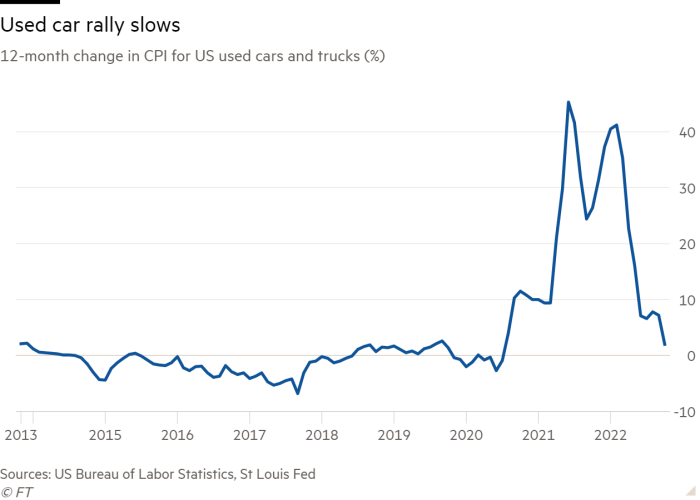

Whereas costs are nonetheless excessive by historic requirements, the beneficial properties are sharply decelerating. In October, they rose 2 per cent yr on yr, the US Bureau of Labor Statistics reported final week, down from an annual charge of greater than 40 per cent in early 2022. On the on-line market Automobiles.com, the median value for a used automobile in October decreased greater than 3 per cent from a yr earlier to $23,499.

The lower has ramifications for producers, sellers, lenders, consumers and doubtlessly the broader financial system as inflation reveals indicators of cooling off.

The value rise of the previous two years was fuelled by a scarcity of new cars and trucks, as a worldwide scarcity of semiconductor chips restricted the variety of automobiles that carmakers may produce. The smaller provide of latest automobiles pressured extra shoppers to show to the used market, together with rental automobile corporations hungry to replenish fleets that they had shrunk throughout the shutdowns of the Covid-19 pandemic.

Now, an elevated provide of latest vehicles and vehicles, plus rising rates of interest because the Federal Reserve fights inflation, are inflicting demand for used vehicles to ebb. Sellers are chopping costs to maintain automobile funds enticing to consumers as increased borrowing prices make financing much less reasonably priced.

“The Federal Reserve decided to boost rates of interest, and for higher or worse, it’s doing its job,” Berman stated. “It’s mainly slowing client demand. The identical automobile on the similar value right now goes to value the shopper much more. That, by default, lowers demand on these vehicles.”

The declining costs of used vehicles are felt by family-owned sellers and enormous chains alike. Two publicly traded sellers, Carvana and CarMax, each outperformed the S&P 500 inventory index in 2020 and 2021, however this yr CarMax’s inventory value has dropped 44 per cent whereas Carvana’s plummeted 96 per cent.

S&P International lately modified its outlook on Carvana to destructive due to weakening revenue margins, money flows and liquidity. Greater than half the seller’s gross revenue per unit comes from promoting loans and different merchandise, however Carvana is poised to lose a share of this enterprise.

“With rising rates of interest, it’s harder for Carvana to compete with the massive banks that may preserve mortgage charges low,” stated S&P analysts David Binns and Nishit Madlani.

The corporate would want to hunt contemporary capital to keep up liquidity in 2024, they added.

Falling used automobile costs historically had been “the canary within the coal mine” for brand spanking new vehicles and vehicles, stated Steve Brown, an analyst at Fitch Scores. They signalled declining demand for brand spanking new automobiles, forcing value cuts and in flip decrease manufacturing by producers.

That sample might not maintain. US carmakers made, on common, about 11.2mn automobiles a yr for the 5 years previous the pandemic, stated Kristin Dziczek, an automotive coverage adviser on the Federal Reserve Financial institution of Chicago.

However the chip scarcity curtailed manufacturing: They made slightly below 9mn a yr in 2020 and 2021 and are forecast to supply lower than 10mn this yr. As a result of producers have constructed fewer new automobiles up to now two years than shoppers wish to purchase, falling used automobile costs might not translate into decrease costs for brand spanking new vehicles and vehicles.

Carmakers have additionally spent the previous two years allocating scarce chips to the costliest variations of their most worthwhile automobiles, primarily abandoning the low finish of the market. Much less prosperous prospects moved into the used automobile market. Carmakers could also be much less inclined to chop costs at the same time as provides rebound “as a result of the low-end purchaser is out of the market”, Brown stated.

At wholesale auctions, consumers are not prepared to pay what sellers are demanding, stated Omair Sharif, president of Inflation Insights, a forecasting and evaluation group. The US client value index for used vehicles fell 2.4 per cent from September to October.

With used automobiles making up 5 per cent of the basket of products used to trace inflation, October’s decline in used automobile costs subtracted greater than a tenth off the core inflation charge, Sharif stated.

“It’s going to grow to be an anchor and pull down on the core charge as we transfer ahead,” he stated. Whereas on a regular basis purchases equivalent to groceries affect folks’s notion of inflation extra, “even in the event you don’t purchase a used automobile each week, it nonetheless helps by way of seeing that the information is coming down”.

[ad_2]

Source link