The CEO of funding administration agency Ark Make investments has warned that if the Federal Reserve doesn’t pivot, the present financial setup will probably be just like 1929 when the Nice Despair began. Tesla CEO and Twitter chief Elon Musk agreed.

The Fed, Inflation, and the Nice Despair

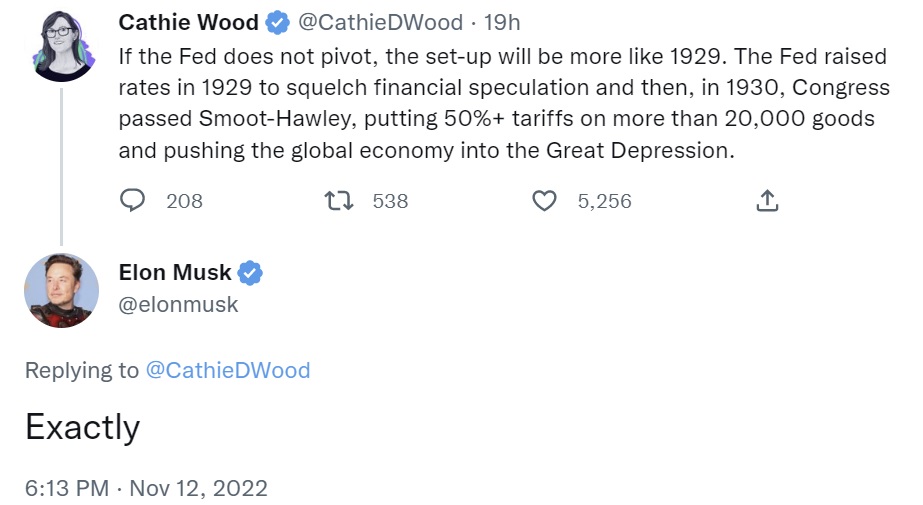

Ark Make investments CEO Cathie Wooden, who can also be the funding administration agency’s founder and CIO, shared her ideas about inflation and the way the Federal Reserve may push the worldwide financial system right into a 1929-like despair in a collection of tweets Saturday.

She defined that the Federal Reserve raised rates of interest “to squelch monetary hypothesis” in 1929, adopted by Congress passing the Smoot-Hawley Tariff Act in 1930, which put greater than 50% tariffs on over 20,000 items and pushed the worldwide financial system into the Nice Despair. “If the Fed doesn’t pivot, the setup will probably be extra like 1929,” she warned. Tesla, Spacex, and Twitter boss Elon Musk concurred.

Wooden identified that “If inflation is unwinding, as we imagine, then we could possibly be heading again to the long run, the Roaring Twenties,” emphasizing:

The setup is remarkably comparable!

The Ark Make investments government famous that the world was at conflict previous to the Roaring Twenties, citing WWI and the Spanish Flu pandemic. Inflation soared throughout that point, peaking at 24% in June 1920, she continued, including that the Federal Reserve responded by elevating rates of interest lower than two-fold from 4.6% to 7% in 1919-1920.

Inflation then dropped “precipitously in a single 12 months to destructive 15% in June 1921,” Wooden stated, noting that “the Fed lowered rates of interest from 7% in Could 1921 to 4% in July 1922, tripping the swap for the Roaring Twenties.” The chief moreover shared:

We might not be stunned to see broad-based inflation flip destructive in 2023.

“Confronted with a lot decrease inflation this time round, the Fed has elevated rates of interest 16-fold, a severe mistake in our view,” she additional opined.

“The College of Michigan’s Shopper Sentiment Survey is at a report low, under ranges hit in 2008-09 and 1979-82, a setup for a liquidity entice like that within the Nice Despair when large financial stimulus failed,” the Ark Make investments chief cautioned.

Noting that the Nice Despair and the Roaring Twenties are two doable outcomes, Wooden described: “Given conflicting knowledge and the stark distinction in these outcomes, the Fed must be debating the doable dangers related to its present coverage, on the very least, as a substitute of voting unanimously.”

Emphasizing the similarity between at present’s financial scenario and the one in 1929, she careworn:

Sadly, at present has some echoes of the identical. The Fed is ignoring deflationary alerts, and the Chips Act may hurt commerce maybe greater than we perceive.

Do you agree with Ark Make investments CEO Cathie Wooden and Tesla CEO Elon Musk in regards to the Fed and the chance of a 1929-like despair? Tell us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss brought on or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.