[ad_1]

The chairman of the U.S. Securities and Change Fee (SEC), Gary Gensler, has outlined two paths the company is taking to control the crypto business. In the meantime, a U.S. congressman is investigating whether or not Gensler helped FTX CEO Sam Bankman-Fried and his bankrupt crypto change on authorized loopholes to acquire a regulatory monopoly.

SEC Chair Gensler on FTX’s Undoing

The chairman of the U.S. Securities and Change Fee (SEC), Gary Gensler, talked about crypto regulation and the undoing of cryptocurrency change FTX in an interview with CNBC Thursday.

With out confirming whether or not the SEC is investigating FTX, the chairman defined that when crypto exchanges “combine collectively a bunch of buyer cash” with out disclosure and “leverage borrowing towards it,” buyers get harm.

He was additionally requested in regards to the watchdog going after Kim Kardashian which, on a relative foundation, is a a lot smaller case than FTX. Gensler replied:

Look, I believe that buyers want higher safety on this area. However I might say this, this can be a discipline that’s considerably non-compliant, however it’s obtained regulation and people laws are sometimes very clear, and we’ve got a number of paths.

“One path is working with these crypto exchanges, crypto lending platforms, and to get them correctly registered and why that issues is that so the general public is protected,” he defined.

One other path is enforcement, Gensler emphasised. “We’ve introduced, between my predecessor and the groups now on the SEC, a minimum of 100 actions … and we’ve been very clear in these varied enforcement actions.” He additionally referenced the regulator’s recent win towards LBRY.

‘Are available, Discuss to Us’

Gensler usually mentioned that crypto buying and selling and lending platforms ought to “are available, discuss to us, and get registered.”

In accordance with his calendar, FTX CEO Sam Bankman-Fried did are available and discuss to him on March 29. “Do you are feeling such as you have been hoodwinked?” he was requested.

The SEC chairman replied:

I believe we’ve been clear in these conferences … non-compliance is just not going to work, the general public goes to be harm, but additionally we’re going to proceed on these twin paths.

He added that if essential, the SEC will likely be “the cop on the beat, going into court docket, placing the details and the legislation in entrance of judges.”

“It’s in regards to the platforms or the intermediaries. This isn’t just like the New York Inventory Change or Nasdaq,” Gensler careworn, including {that a} handful of crypto lending and buying and selling platforms “comingle” belongings. He opined:

It’s one other poisonous mixture the place they take folks’s cash, they borrow towards it, it’s not a lot disclosure, after which they commerce towards their clients.

The chairman added that the SEC is specializing in these platforms however “Constructing the proof, constructing the details usually takes time.”

Congressman Investigating Whether or not Gensler Helped FTX on Authorized Loopholes

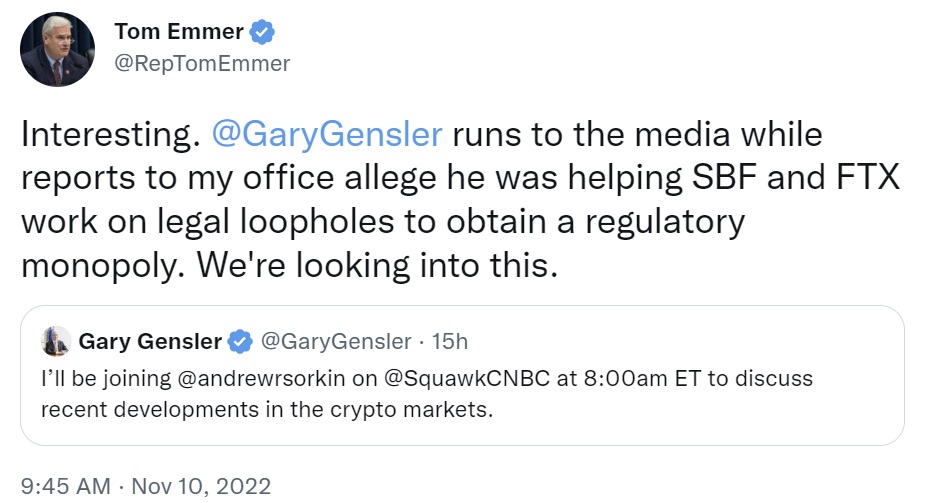

Following Gensler’s interview, Congressman Tom Emmer tweeted that his workplace has acquired reviews alleging that the SEC chairman helped Bankman-Fried and FTX work on authorized loopholes to acquire a regulatory monopoly. “We’re trying into this,” the lawmaker wrote.

Final week, 4 congressmen accused Gensler of “hypocritical mismanagement of the SEC,” emphasizing that he refuses to follow what he preaches. This week, two lawmakers mentioned they have been “deeply involved” that the SEC is enacting guidelines too quickly, with out enough suggestions. Gensler has additionally been criticized for taking an enforcement-centric method to regulating the crypto business.

What do you consider the feedback by SEC Chairman Gary Gensler and Congressman Tom Emmer? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, lev radin

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss induced or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link