[ad_1]

Binance is dumping all of its FTX token (FTT) holdings “As a consequence of latest revelations which have come to gentle,” CEO Changpeng Zhao has confirmed. “Concerning any hypothesis as as to if this can be a transfer towards a competitor, it isn’t,” he added. “Our trade is in its nascency and each time a mission publicly fails it hurts each person and each platform.”

Binance Liquidating All FTX Tokens on Its Books

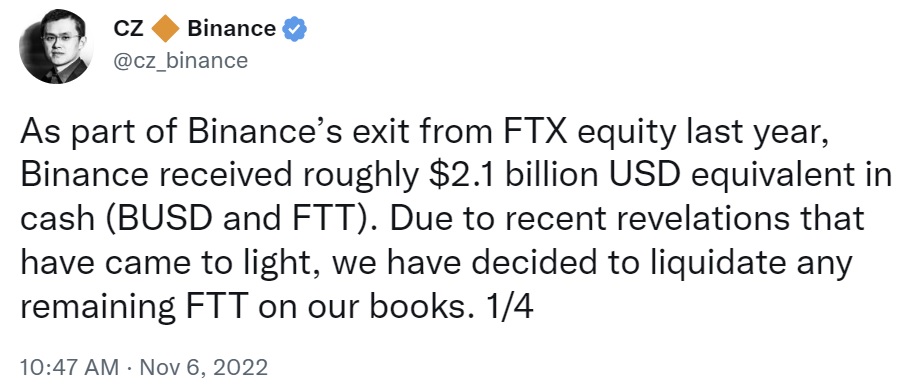

The CEO of world cryptocurrency alternate Binance, Changpeng Zhao (CZ), introduced through Twitter Sunday that his alternate is liquidating all the FTX tokens (FTT) on its books.

The chief defined that Binance acquired $2.1 billion in BUSD (Binance’s stablecoin) and FTT from exiting FTX fairness final yr. Binance was an early FTX investor. “As a consequence of latest revelations which have come to gentle, we have now determined to liquidate any remaining FTT on our books,” Zhao wrote.

In follow-up tweets, the Binance boss added: “We’ll attempt to take action in a method that minimizes market impression. As a consequence of market circumstances and restricted liquidity, we count on this may take just a few months to finish.” He additional stated. “We usually maintain tokens for the long run. And we have now held on to this token for this lengthy.”

CZ additionally detailed:

Liquidating our FTT is simply post-exit danger administration, studying from LUNA. We gave assist earlier than, however we gained’t fake to make love after divorce. We aren’t towards anybody. However we gained’t assist individuals who foyer towards different trade gamers behind their backs. Onwards.

Noting that “Binance all the time encourages collaboration between trade gamers,” the CEO claimed that the sale just isn’t “a transfer towards a competitor” as some have speculated. He continued: “Our trade is in its nascency and each time a mission publicly fails it hurts each person and each platform.”

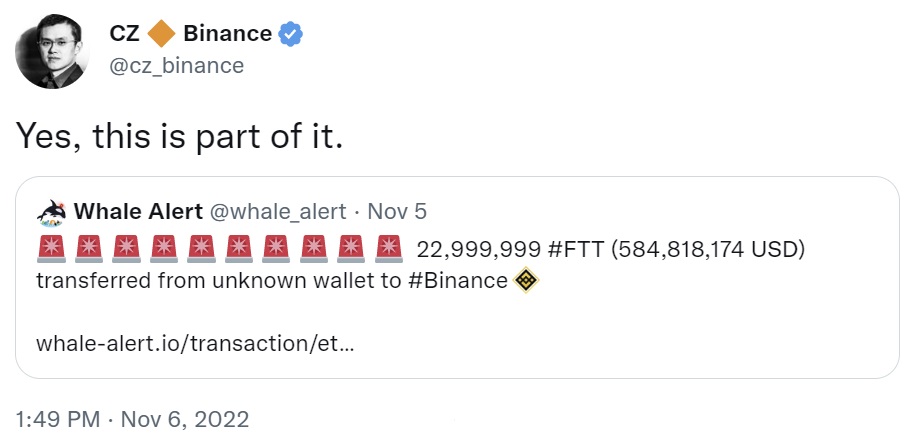

Quickly after his announcement, CZ admitted that the 22,999,999 FTT transferred to Binance on Nov. 5 was a part of his alternate’s FTX token exit transfer.

Sam Bankman-Fried’s Response

Commenting on the Binance CEO’s tweet about FTT, FTX CEO Sam Bankman-Fried wrote: “I used to be going to write down a unique thread, however I took a deep breath and reminded myself of one thing we’d all do nicely to recollect: that we’re all on this collectively, and I want the perfect to ‘everybody’ driving the trade ahead.” He continued:

As a result of I respect the hell out of what y’all have finished to construct the trade as we see it at this time, whether or not or not they reciprocate, and whether or not or not we use the identical strategies. Together with CZ.

FTX revealed a document titled “Doable Digital Asset Trade Requirements” on Oct. 19 which acquired a lot backlash from the crypto trade. Bankman-Fried, who’s a mega-donor to the Democratic get together, has been under fire for his controversial feedback on the decentralized finance (defi) protocol. In the meantime, CZ is a significant defi supporter, stating beforehand: “Binance is investing closely in defi.”

As well as, some individuals consider that the FTT sale is also associated to the monetary well being of Alameda Analysis, a principal buying and selling agency based by Bankman-Fried. On Friday, Soiled Bubble Media revealed an article outlining explanation why Alameda Analysis’s funds “seem to relaxation on the identical scheme that destroyed Celsius Network.” The article cites a leaked steadiness sheet.

What do you consider Binance dumping all of its FTX token holdings? Tell us within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss precipitated or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link