[ad_1]

Previously 9 months inflation has surged, inventory costs have fallen and world development has stalled. Everybody appears to be hurting — everybody, that’s, besides oil corporations.

Whereas the vitality disaster sparked by Russia’s invasion of Ukraine has pushed up the price of gasoline, electrical energy and hundreds of different on a regular basis gadgets, fossil gasoline producers, and their shareholders, have gotten richer.

Income on the largest US oil firm, ExxonMobil, tripled within the third quarter to a document of almost $20bn, bringing its earnings for the yr to greater than $43bn. Shell, Europe’s largest, has made $30bn this yr, together with $9.5bn within the three months to September. BP is on target for probably probably the most worthwhile yr in its historical past.

In response, politicians from Washington to London to Milan have discovered themselves threatening or enacting the identical coverage response: windfall taxes.

“Their earnings are a windfall of battle — a windfall from the brutal battle that’s ravaging Ukraine and hurting tens of hundreds of thousands of individuals across the globe,” US president Joe Biden stated this week as he promised elevated levies on producers until they assist minimize US gasoline prices.

Rishi Sunak, as UK chancellor, stated it was “fiscally accountable” to tax oil and fuel producers’ “extraordinary” earnings when he introduced an vitality earnings levy in Could. 5 months later, Sunak, now prime minister, is contemplating rising the levy from 25 per cent to 30 per cent and lengthening it to 2028.

In Europe, the EU launched a “solidarity contribution” levy of at the least 33 per cent of “surplus taxable earnings” made by fossil gasoline corporations. Italy has additionally launched a 25 per cent windfall tax on vitality firm earnings, whereas Spain has proposed a 1.2 per cent extra tax on vitality firm gross sales, in addition to a 4.8 per cent levy on financial institution earnings.

The politics of windfall taxes are easy: few voters object to companies — significantly oil majors — being squeezed after profiting throughout onerous occasions. However designing and implementing them is much less so, significantly when corporations have world earnings and funding in new, greener sources of vitality is required.

A recurring theme

Windfall taxes should not new. Within the first years of the primary world battle at the least 22 nations, together with the UK, US, France, Italy and Germany adopted some type of further tax on “extra” company earnings.

Through the second world battle, an extra earnings tax within the US generated 22 per cent of presidency tax receipts in 1943, equal to 2.2 per cent of gross home product, in keeping with the IMF.

Within the vitality business, authorities efforts to seize higher tax income during times of excessive costs are a recurring theme. Many producing nations, reminiscent of Australia, Nigeria and Brazil, have tax regimes that embody a mechanism to make sure the state beneficial properties if costs rise.

Within the UK, which taxes earnings reasonably than manufacturing, the Treasury has recurrently tweaked the tax charge over the previous 50 years relying on the oil value, explains Graham Kellas, head of fiscal coverage analysis at vitality consultancy Wooden Mackenzie.

“The UK oil and fuel tax coverage because it started has principally been to control what’s taking place with costs and alter the tax charges while you really feel that the worth stage has shifted,” he says.

Most just lately, then chancellor George Osborne in 2011 raised the supplementary tax charge paid by oil and fuel producers from 20 per cent to 32 per cent after oil costs spiked. It was then minimize to 10 per cent between 2014 and 2016 as costs fell.

Taxing earnings reasonably than manufacturing allows the UK to “take extra later” and proceed to draw funding, however the “advert hoc” charge modifications additionally create uncertainty, says Kellas.

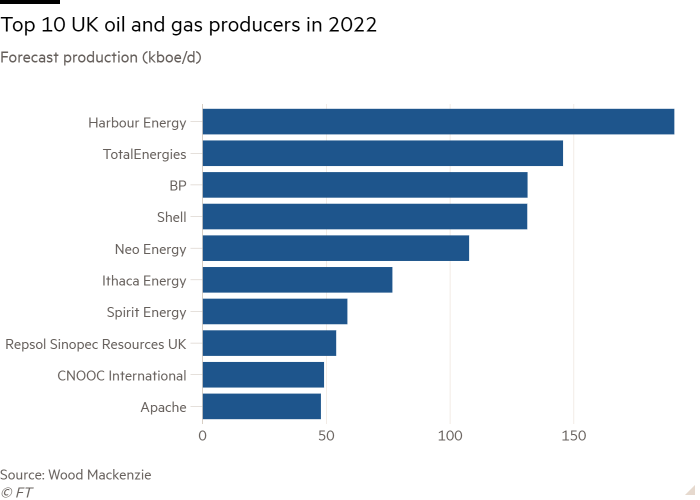

To date the vitality earnings levy within the UK has had a combined impression. This week, BP, which is the third-largest oil and fuel producer within the North Sea, stated its UK enterprise anticipated to pay about $2.5bn in taxes in 2022, together with about $800mn underneath the brand new levy.

Personal equity-backed Harbour Vitality, which is the UK’s largest producer, expects to pay $900mn in UK taxes this yr, together with $400mn underneath the levy.

![US president Joe Biden: ‘The [energy groups’] profits are a windfall of war — a windfall from the brutal conflict that is ravaging Ukraine and hurting tens of millions of people around the globe’](https://www.ft.com/__origami/service/image/v2/images/raw/https%3A%2F%2Fd1e00ek4ebabms.cloudfront.net%2Fproduction%2F337cb9e0-5398-42c7-b04a-983ac18cd0ce.jpg?fit=scale-down&source=next&width=700)

In distinction, Shell, which like BP produces about 120,000 barrels of oil equal a day within the UK, has paid no UK taxes in any respect this yr. Investments in new manufacturing and prices related to decommissioning previous fields have cancelled out all UK earnings, it stated. Actually, Shell has paid no taxes on its UK oil and fuel manufacturing since 2017.

Maybe conscious of the poor optics of paying no tax within the UK whereas returning billions of {dollars} of document profits to shareholders, outgoing chief govt Ben van Beurden has stated his UK-headquartered firm is willing to pay more.

“[Governments] will probably be corporations like us who profit from the volatility and the costs that we see, to fund the programmes they’re rolling out,” van Beurden stated final week after Shell reported the second-highest quarterly revenue in its historical past. “I believe we’ve got to just accept it and we’ve got to embrace it.”

That view, nonetheless, just isn’t shared throughout the business. Whereas Shell generates earnings world wide, most of the producers within the North Sea are extra depending on their UK revenues.

“It received’t be the oil majors who will bear the brunt of the impression of unpredictable windfall taxes,” says Iain Pyle, funding director at UK-based asset supervisor Abrdn, a high 10 shareholder within the North Sea fuel group Serica Vitality.

“As an alternative, the burden will fall on smaller home producers and on native service corporations and personal contractors,” he says. “These corporations and their provide chains are much less capable of stand up to a five-year interval of excessive taxation and can’t merely relocate.”

Sam Laidlaw, founder and govt chair of Neptune Vitality, which produces about 12 per cent of its oil and fuel within the UK, says introducing increased taxes is OK whether it is clear why they’re being launched and for the way lengthy.

The EU’s “solidarity contribution” will solely apply to earnings made in 2022 or 2023, he says. In distinction, the UK’s vitality earnings levy applies to the tip of 2025 and is likely to be prolonged to 2028.

“We have now had one change [in the UK tax regime] already this yr, which was launched at fairly brief discover with very restricted session,” Laidlaw says. “If we’ve got additional modifications, that basically undermines the entire stability query.”

What authorities desires

There’s a contradiction on the coronary heart of many western governments’ strategy to the fossil gasoline business for the reason that begin of the disaster.

After years of calling on the sector to scale back emissions, policymakers now need corporations to spice up provide, whereas nonetheless urging the identical executives to ship a long-term transition to greener fuels.

World earnings within the third quarter

Regardless of a dedication to chop emissions to web zero by 2050, the UK nonetheless desires to encourage funding in oil and fuel manufacturing that it says is critical for the nation to have ample sources of vitality till it could possibly totally transition to greener types of energy.

Consequently, the vitality earnings levy features a beneficiant “tremendous deduction” for investments in new oil and fuel manufacturing that rewards corporations with an total 91p tax saving for each £1 they make investments.

Professor Michael Devereux on the Oxford college Centre for Enterprise Taxation says this has, in impact, created a subsidy for fossil gasoline tasks that in any other case wouldn’t go forward. “A subsidy could possibly be justified for funding in renewables, however it’s a lot tougher to justify for funding in oil and fuel,” he says.

Within the US, a Biden administration that originally talked of curbing new drilling and accelerating a transition from oil has shifted to threatening to penalise corporations until they energy up extra rigs. “In the event that they don’t, they’re going to pay a better tax on their extra earnings and face different restrictions,” Biden stated this week.

But most analysts see the specter of new federal taxes on US oil firm earnings as little greater than marketing campaign rhetoric forward of midterm elections subsequent week.

An act of Congress would most likely be required, which might meet resistance from some Senate Democrats and blanket opposition from the Republicans, who polls recommend will management at the least one of many homes of Congress after Tuesday’s vote.

State-level interventions are extra believable, significantly if excessive costs persist, says Kevin Guide, managing director at Clearview Vitality Companions, a Washington advisory agency.

“Excessive costs are likely to make governments grabby, and a recession may pressure state and native authorities funds,” he says. “In that context, even some producer states would possibly start to eye business earnings — probably resulting in a . . . modification of present incentives, if not new levies.”

Sowing the windfall

Windfall taxes are sometimes not a assured income raiser. Italy’s levy introduced in billions lower than anticipated, as many vitality corporations merely refused to pay and introduced authorized challenges towards the federal government.

A part of the problem for governments is that the eye-popping earnings figures from the likes of BP and Shell, which provoke probably the most outrage from voters, are world earnings and the portion topic to UK tax is way smaller. Conference dictates that nations don’t tax international earnings, that are usually taxed within the jurisdiction the place these earnings are made.

BP reported quarterly earnings of $8.2bn this week however maybe 10 per cent was generated within the UK, says Kellas at Wooden Mackenzie. (BP, like Shell, doesn’t break down its earnings by geography.)

Murray Auchincloss, BP’s chief monetary officer, says that though individuals are “understandably centered on our world revenue ranges” at a “tough time for society”, his firm doesn’t shirk its duties to the UK taxpayer.

He says that within the UK, $2 out of each $3 the corporate makes goes to the federal government. Worldwide, BP paid $5bn in taxes within the third quarter at a mean tax charge of 37 per cent, he provides.

The rewards should not solely going to shareholders, however being invested within the vitality transition, he notes. BP plans to spend £18bn within the UK within the subsequent decade, primarily in renewables and applied sciences reminiscent of carbon capture and storage.

“I get that governments have a really tough problem proper now,” he says, “however actually we’re simply centered on attempting to speculate and pay taxes.”

Nonetheless, because the social prices of the disaster develop, some are calling for extra radical options. Dan Neidle, a former tax specialist at Clifford Probability who based the non-profit Tax Coverage Associates, argues that though taxing international earnings is generally thought of “unhealthy manners”, a one-off exception could possibly be made if taxing the home earnings of UK-headquartered vitality corporations proves inadequate.

It could possibly be completed, he says, “if we credibly say it’s a one-off and received’t be repeated”. The danger of corporations relocating their headquarters to keep away from taxation could be decrease than folks assume, he argues, including that double taxation treaties could possibly be used to forestall any group paying tax twice on the identical earnings. “Shell is crying out to be taxed extra,” he says.

Further reporting by David Sheppard

[ad_2]

Source link