[ad_1]

Good morning. This text is an on-site model of our FirstFT e-newsletter. Signal as much as our Asia, Europe/Africa or Americas version to get it despatched straight to your inbox each weekday morning

The Financial institution of England has signalled that borrowing prices won’t rise as a lot as markets anticipate sooner or later, even because it imposed the biggest rate increase in three decades to fight hovering inflation.

The BoE’s 0.75 proportion level bump to three per cent took rates of interest to their highest level since 2008. However the central financial institution issued unusually robust steering that charges wouldn’t must rise a lot additional to carry inflation again to its 2 per cent goal, partly as a result of it forecast a protracted recession forward.

The transfer adopted equivalent will increase by the US Federal Reserve on Wednesday and the European Central Financial institution final week as financial authorities worldwide sought to cope with rising inflation, which has reached a 40-year excessive of 10.1 per cent within the UK.

Steering and financial forecasts revealed by the BoE advised it was taking a extra dovish stance on rates of interest than the Fed, whose chair Jay Powell this week labelled discuss of pausing rate of interest rises as “very untimely”.

Thanks for studying. FirstFT Europe/Africa shall be again in your inbox on Monday — Gary

5 extra tales within the information

1. Ping An requires ‘aggressive’ cost-cutting at HSBC The financial institution’s largest shareholder has referred to as for “far more aggressive” cost reduction and job cuts, whereas warning that its board lacks expertise in Asia. Chinese language insurer Ping An has been privately urging HSBC to hive off its Asian operations to spice up returns.

2. Sunak anticipated to shelve plans to privatise Channel 4 Prime Minister Rishi Sunak is anticipated to scrap the proposed privatisation of publicly owned UK broadcaster Channel 4 as he reassesses coverage pledges by his predecessors to streamline a packed legislative programme. Channel 4 has confronted half a dozen privatisation proposals because it was launched in 1982.

3. LNG tankers idle off Europe’s coast as merchants look ahead to fuel value rise Greater than 30 tankers holding $2bn value of liquefied pure fuel are floating just off Europe’s shoreline, as power merchants guess an autumn value reprieve will show to be fleeting and the glut of pure fuel in Europe’s storage attracts down.

4. UK to ban ship insurance coverage cowl for Russian oil forward of G7 value cap The ban will cut off access to the vital Lloyd’s of London market for seaborne Russian cargoes, the Treasury mentioned, and is a key step within the G7’s makes an attempt to impose a value cap on Russian oil exports because the insurance coverage ban can be waived for international locations that signal as much as the scheme.

5. China’s central financial institution struggles to pressure tech teams to share consumer information with state The Individuals’s Financial institution of China is struggling to get tech giants to share users’ personal information with state-backed credit-scoring corporations as a part of efforts to evaluate potential debtors’ creditworthiness. The stand-off comes as Beijing works to tighten its grip on the nation’s tech sector.

How nicely did you retain up with the information this week? Take our quiz.

The times forward

Financial information S&P releases its Eurozone Composite PMI report in the present day, whereas the US and Canada have October employment figures.

Earnings Duke Vitality, Itochu and Telefónica launch quarterly earnings in the present day. Warren Buffett’s Berkshire Hathaway experiences third-quarter earnings tomorrow.

Bahrain Pope Francis continues his first journey to the the predominantly Muslim nation to deal with the Bahrain Discussion board for Dialogue, a convention with the theme “East and West for Human Coexistence”.

What else we’re studying

Starbucks’ Schultz: ‘The soul of the corporate was being compromised’ 4 years after retiring and three since his abortive presidential marketing campaign, Howard Schultz is again for a 3rd shift as Starbucks’ chief government. In an interview with the Monetary Occasions, he discusses succession, a barista revolt, the influence of the pandemic and the challenges forward for the worldwide espresso chain.

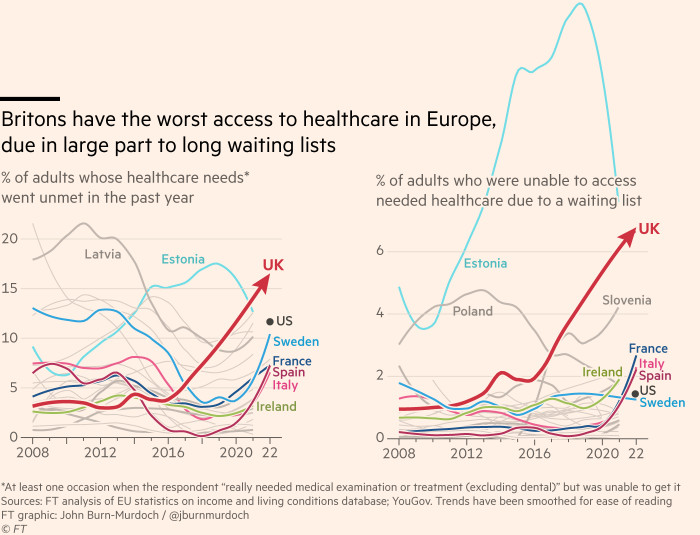

‘Britons now have the worst entry to healthcare in Europe’ The UK is now roughly three years into a gradual march of power sickness that’s scything by way of probably the most weak and marginalised, writes John Burn-Murdoch, and prolonged ready lists are stopping tens of millions from accessing the providers they want.

Kherson residents describe reign of terror underneath Russian rule As Ukraine pursues its counteroffensive in Kherson, these residing within the southern area have mentioned the occupying authorities are terrorising anybody who defies them, with an alleged public hanging of a defiant girl only one instance of Moscow’s brutality in occupied territory.

‘They used me and threw me out’: The woes of Qatar’s World Cup employees Preparations for the World Cup have been dogged by long-running accusations that the imported employees who’ve constructed the stadiums and associated infrastructure have endured depressing circumstances, together with low wages, non-payment of salaries and unsafe workplaces.

“They forcefully despatched employees away, together with me. It was not my option to return to Nepal.” —Jeevan, a Nepalese migrant employee who took out a high-interest mortgage value $1,400 to safe a job in Qatar

Executives get up to their collective blind spots We learnt from the monetary disaster that when networks lack range, they’re weak to a single shock, writes Gillian Tett. However what’s placing, looking back, is that the non-financial world appears to have learnt so little from it.

Journey

FT Globetrotter editors weigh in on how to make the most of your next trip on this episode of the FT Weekend podcast. Take a look at Globetrotter for extra on doing karaoke in Tokyo with your boss, New York’s high-end Korean food scene and extra.

Thanks for studying and keep in mind you’ll be able to add FirstFT to myFT. You too can elect to obtain a FirstFT push notification each morning on the app. Ship your suggestions and suggestions to firstft@ft.com

[ad_2]

Source link