[ad_1]

Throughout the previous few weeks, various people have been discussing the upcoming launch of Bitcoin Core model 24.0 and the way the codebase will embrace full-replace-by-fee (RBF) logic. The dialogue has change into controversial as just a few Lightning Community and 0 affirmation advocates have expressed a distaste for the full-RBF concept. The CEO of Synonym, John Carvalho, has been a vocal critic of the proposal on Twitter and on Nov. 3, Carvalho remarked {that a} subset of Core builders “are at the moment making an attempt to assault Bitcoin by forcing a pet agenda to make all transactions RBF by default.”

Bitcoin Core Model 24.0 to Present Full-RBF Logic, Zero-Affirmation and Lightning Community Advocates Communicate out Towards the Proposal

Ever since replace-by-fee (RBF) was introduced in 2014 by software program developer Peter Todd, the subject has been a delicate topic. Primarily, RBF permits bitcoin customers to leverage the function so as to substitute an unconfirmed transaction with an alternate transaction with an elevated payment. Nevertheless, when a transaction is included in a block, it can’t be outdated by RBF at that time. The scheme solely works with zero-confirmation (0-conf) transactions (txns). Zero-confirmation transactions are transfers that may be accepted by a service provider or service by way of a community broadcast, properly earlier than a miner confirms the transaction in a block.

In keeping with varied reports, Bitcoin Core model 24.0 will present full-RBF logic and the thought has fueled extra controversy. “Till now, Bitcoin Core nodes utilized the ‘first seen’ rule, which meant that conflicting transactions wouldn’t be accepted within the node’s reminiscence pool (mempool) and forwarded to friends,” a summary described by Bitcoin Journal particulars. “With this upcoming launch, customers can select to make their nodes settle for and ahead conflicting transactions in the event that they embrace the next payment than (the) earlier transaction(s) they battle with.”

Nevertheless, Bitcoin Journal’s abstract doesn’t embrace the controversial arguments towards full-RBF logic. A variety of critics have stated that transaction substitute harms the community, and that it helps promote double-spend attacks. The double spend attack assertion has been argued since RBF was first launched into Bitcoin Core model 0.12. In one other abstract of Bitcoin Core model 24.0, a Medium post printed on Oct. 29, the writer mentions a number of the detractors and arguments towards the full-RBF scheme. The writer quotes the founding father of the Lightning Community (LN) pockets Muun, Dario Sneidermanis.

“Throughout the previous few days, we now have been investigating the newest Bitcoin Core launch candidate, and we discovered some worrying info concerning the deployment of opt-in full-RBF,” Sneidermanis defined. The Muun CEO additional added that “zero-conf apps (like Muun) should now immediately disable zero-conf options.” Sneidermanis’ critique of the proposed change continued:

We at Muun must flip off outbound Lightning funds for greater than 100,000 customers, which is at the moment a superb portion of all non-fiduciary Lightning funds.

Synonym CEO John Carvalho Says RBF Makes ‘Spending Bitcoin Extra Harmful for Customers and Companies’

The Medium submit describing Bitcoin Core model 24.0 additionally mentions individuals who disagree with the Muun CEO’s evaluation. As an illustration, Bitcoin Core developer David Harding says the improve “doesn’t change transaction substitutability in any vital method.” The weblog submit particulars that “Pieter Wuile makes the same argument,” and software program Developer Luke Dashjr has already carried out full-RBF logic in his software program Bitcoin Knots codebase. A number of days after the Medium post was printed, the CEO of Synonym, John Carvalho, tweeted concerning the dialogue and he included some accusations.

“A subset of Core devs are at the moment making an attempt to assault Bitcoin by forcing a pet agenda to make all transactions RBF by default,” Carvalho wrote on Nov. 3, 2022. “This assault contains bitcoin-dev mailing listing lies and lobbying, code modifications in Core node, and bribery makes an attempt to miners. Retailers depend on 0-conf txns as a approach to meet shopper wants in commerce. RBF makes the mempool much less dependable and spending bitcoin extra harmful for shoppers and companies,” Carvalho added.

The extra customers there are spending BTC, the extra useful it’s.

— John Carvalho (@BitcoinErrorLog) November 4, 2022

Carvalho’s opinion was met with controversy and one consumer tweeted that “counting on 0-conf transactions doesn’t appear very sensible when nearly all of onchain transactions are solely going to be very giant worth transactions sooner or later.” Carvalho responded and insisted that “it’s not your resolution what quantity of threat is suitable to another person.” One other individual told Carvalho that full-RBF “appears [like a] good incentive for LN and fewer L1 bloating. Intermediate time [obvious] ache for retailers. However non-RBF is rarely going to remain worthwhile for many retailers.”

The Synonym CEO replied and stressed:

That could be a declare and prediction that conflicts with observable actuality.

Robust Majority of No Votes Shoot Down Carvalho’s Argument, Peter Todd Says Miners Have Contacted Him Asking for Full-RBF

The identical day, Carvalho asked folks to show that “Double spending was all the time straightforward and doable.” “Show it,” the Synonym CEO remarked. “[Double spend] at [Bitrefill], they actually need check examples.” The next day, Carvalho provided his RBF “argument, and resolution, simplified, with out sensation.”

Carvalho’s argument printed to Github was shot down by a lot of NACKs (Vote for No) and one individual said: “As somebody who has had transactions get caught earlier than, having the ability to RBF simply is the perfect expertise for customers.” One other individual detailed that he believes 0-conf transactions will not be secure and stated:

[NACK] zero-conf isn’t a secure, making it a tiny bit tougher to RBF is delusional.

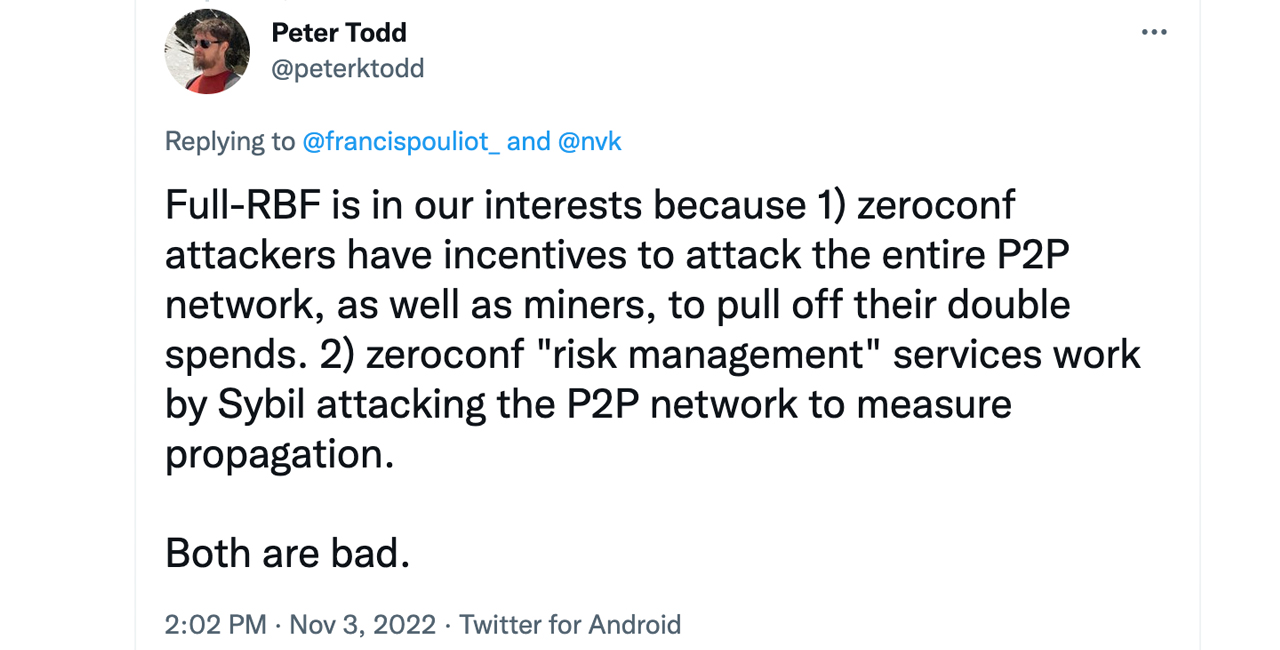

Software program developer Peter Todd has been arguing towards Carvalho’s argument on Github as properly and defined that he was contacted by bitcoin miners. “I personally have been just lately contacted by miners asking how they’ll flip [full RBF] on. Clearly, pointing them to a config possibility is easiest for them,” Todd told Carvalho. Moreover, Todd pressured that there’s demand for the total RBF function. “There’s clearly demand for this feature,” Todd said. “Appears that the motivation to take away it comes from trying to make zero conf safer,” the software program developer added.

The Github consumer working the deal with “Greenaddress” wrote: “NACK. I deliberate to make use of this function each personally in addition to on manufacturing for instance on esplora/blockstream.data and Inexperienced pockets.” Greenaddress additional criticized the replace-by-fee flag mechanism.

“As others have stated we will additionally compile Bitcoin core however it could be an inconvenience and normally I believe the [RBF] flag gives a false sense of safety particularly as we seen just lately even non-standard transactions can discover their [way] to miners. Principally agree with afilini/ptodd/dbrozzoni’s factors,” Greenaddress concluded. One particular person, nonetheless, questioned the aim behind Greenaddress, saying that it deliberate to “use this function each personally in addition to on manufacturing.”

“For what objective?” the person asked Greenaddress on Github. “I haven’t seen a solution to ‘Does [full-RBF] supply any advantages apart from breaking [zero-conf] enterprise practices? If that’s the case, what are they?’ But; does the above indicate you may have one?”

What do you consider the controversy surrounding the total RBF function that builders have proposed so as to add to Bitcoin Core’s codebase? What do you consider Sneidermanis’ and Carvalho’s arguments towards full RBF logic? Tell us what you consider this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss brought on or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link

Huge Games Selection

Huge Games Selection