[ad_1]

The Financial institution of England painted two photos of the outlook for the UK economic system on Thursday. Each situations have been bleak.

No matter occurred, mentioned the central financial institution, the British economic system was slipping right into a recession that might final no less than all of subsequent 12 months. In contrast to the Federal Reserve, which on Wednesday was nonetheless hoping for a “smooth touchdown” for the US economic system, the BoE’s speak was of falling gross home product and a “very difficult” outlook.

Andrew Bailey, BoE governor, mentioned this was inevitable as a result of there have been “essential variations between what the UK and Europe have been dealing with when it comes to shocks and what the US is experiencing”. Europe, not like the US, has been grappling with hovering gasoline costs following Russia’s invasion of Ukraine.

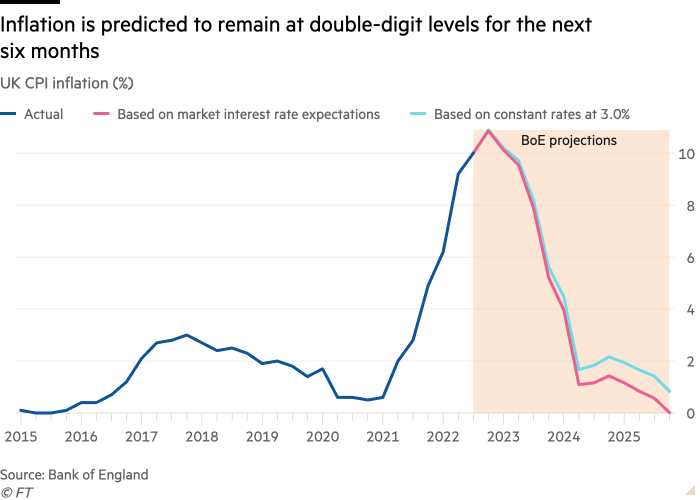

The BoE’s grim predictions didn’t finish with recession. Inflation would keep above 10 per cent for the following six months, and above 5 per cent for the entire of 2023. Unemployment, presently at a 50-year low of three.5 per cent, would finish subsequent 12 months above 4 per cent.

If all of this ache was frequent to each of the BoE’s situations, the variations between them have been key to the central financial institution’s messaging.

Within the first BoE state of affairs — usually thought of its headline forecast — predictions have been based mostly on the idea that monetary market expectations for future rates of interest would contain them peaking at 5.25 per cent subsequent 12 months.

Had been charges to prime out at this stage, the BoE Financial Coverage Committee thought it more than likely the UK must endure eight quarters of financial contraction: the longest recession for the reason that second world warfare. Unemployment would rise to six.4 per cent. This financial ache would weigh on inflation, sending it to right down to zero by late 2025.

However with the BoE having an inflation goal of two per cent, Bailey was clear this state of affairs urged markets risked getting their bets flawed on future financial coverage. “We predict [the] financial institution charge must go up by lower than presently priced into monetary markets,” mentioned Bailey.

The BoE’s different state of affairs — which is often buried within the central financial institution’s forecasting paperwork — that rates of interest keep fixed on the present stage of three per cent was given rather more prominence in shows by Bailey and his group.

Underneath this prediction, output would nonetheless shrink, however by solely half as a lot as within the first state of affairs, leading to a gentle recession by historic requirements. Inflation would fall to 2.2 per cent in two years’ time, earlier than slipping beneath the BoE’s goal. Unemployment would rise, however solely to five.1 per cent.

Many economists mentioned the BoE’s different state of affairs was a transparent sign by the central financial institution that it was near being completed with rate of interest rises, now it had elevated them from 0.1 per cent a 12 months in the past to three per cent, the very best stage since 2008.

Kallum Pickering, economist at Berenberg, mentioned the recessionary overkill within the BoE’s first state of affairs meant the central financial institution “could must do a lot, a lot lower than the market expects when it comes to additional charge hikes to return inflation to its 2 per cent goal”.

When requested which of its two situations the BoE thought was more than likely to occur, Bailey wouldn’t be drawn. He didn’t wish to pin himself right down to a selected view of future rates of interest, saying: “The place the reality is between the 2, we’re not giving steerage on that.”

His principal motive for refusing to be extra particular is the likelihood that inflation proves extra entrenched than the BoE presently thinks.

Bailey mentioned that whereas no prediction would ever be precisely proper, the principle danger was that inflation would nonetheless be larger than the central forecasts in each BoE situations.

One key hazard for the BoE is that wage progress may simply keep larger than it might like, with firms feeling in a position to elevate costs with out dropping an excessive amount of enterprise.

Ruth Gregory, economist at Capital Economics, mentioned the BoE’s many revisions upward for market expectations on future rates of interest over the previous 12 months urged inflation may show “stickier” than it hoped.

By the tip of the day, markets had taken scant discover of the BoE’s dovish state of affairs. Earlier than the BoE’s announcement at midday, markets have been pricing in rates of interest peaking at 4.75 per cent subsequent 12 months. By the tip of the day, they have been betting they’d prime out at 4.72 per cent subsequent September.

Market expectations for future financial coverage will transfer round, and Bailey was eager to focus on what would information BoE selections within the weeks forward.

Most essential, he mentioned, can be the evolution of financial information, notably on wages and corporations’ pricing methods. If these soften, the BoE would really feel much less want to lift rates of interest additional.

The trail of wholesale power costs would even be essential, and the BoE shall be hoping that these reasonable additional, having greater than halved since late August.

The opposite essential issue shall be chancellor Jeremy Hunt’s autumn assertion on November 17. If the federal government proceeds with fast public spending cuts and tax will increase to fill a gaping gap within the public funds, it’s going to depress the economic system additional and ease the strain on the BoE to lift rates of interest.

Ben Broadbent, BoE deputy governor, urged any fiscal motion by the federal government would want to occur “within the comparatively close to time period” to affect the central financial institution’s rate of interest selections.

[ad_2]

Source link