[ad_1]

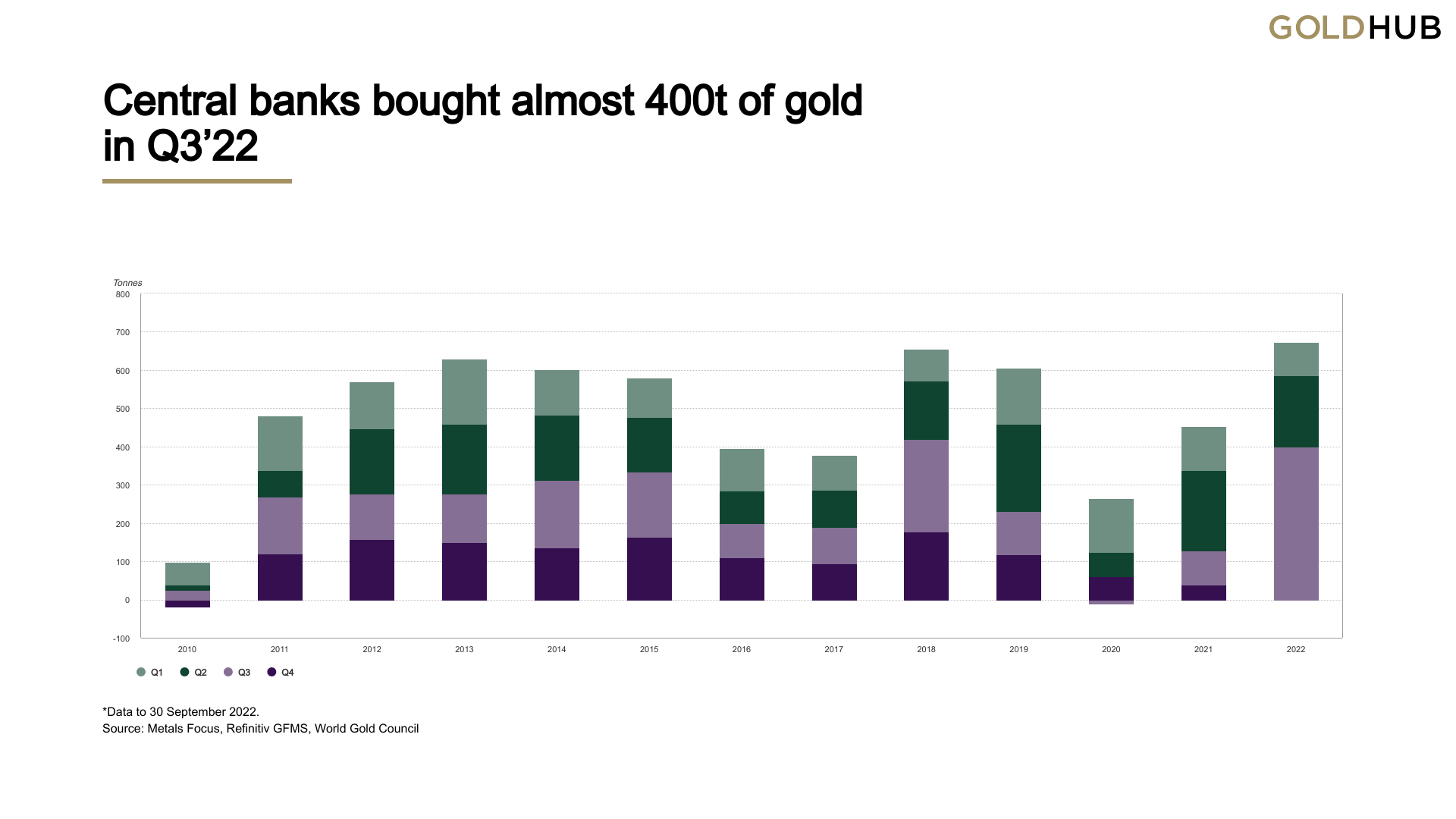

In line with the World Gold Council’s (WGC) newest quarterly report, worldwide gold demand, excluding over-the-counter (OTC) markets, was 28% greater year-over-year. Whereas demand jumped greater than final yr within the third quarter, central financial institution gold shopping for tapped an all-time quarterly report in Q3 2022. The quarterly report signifies that the world’s central banks bought near 400 tons of gold and the WGC examine says that it’s the “most on report.”

Q3 2022 Knowledge Reveals the World’s Central Banks Stacked Near 400 Tons of Gold

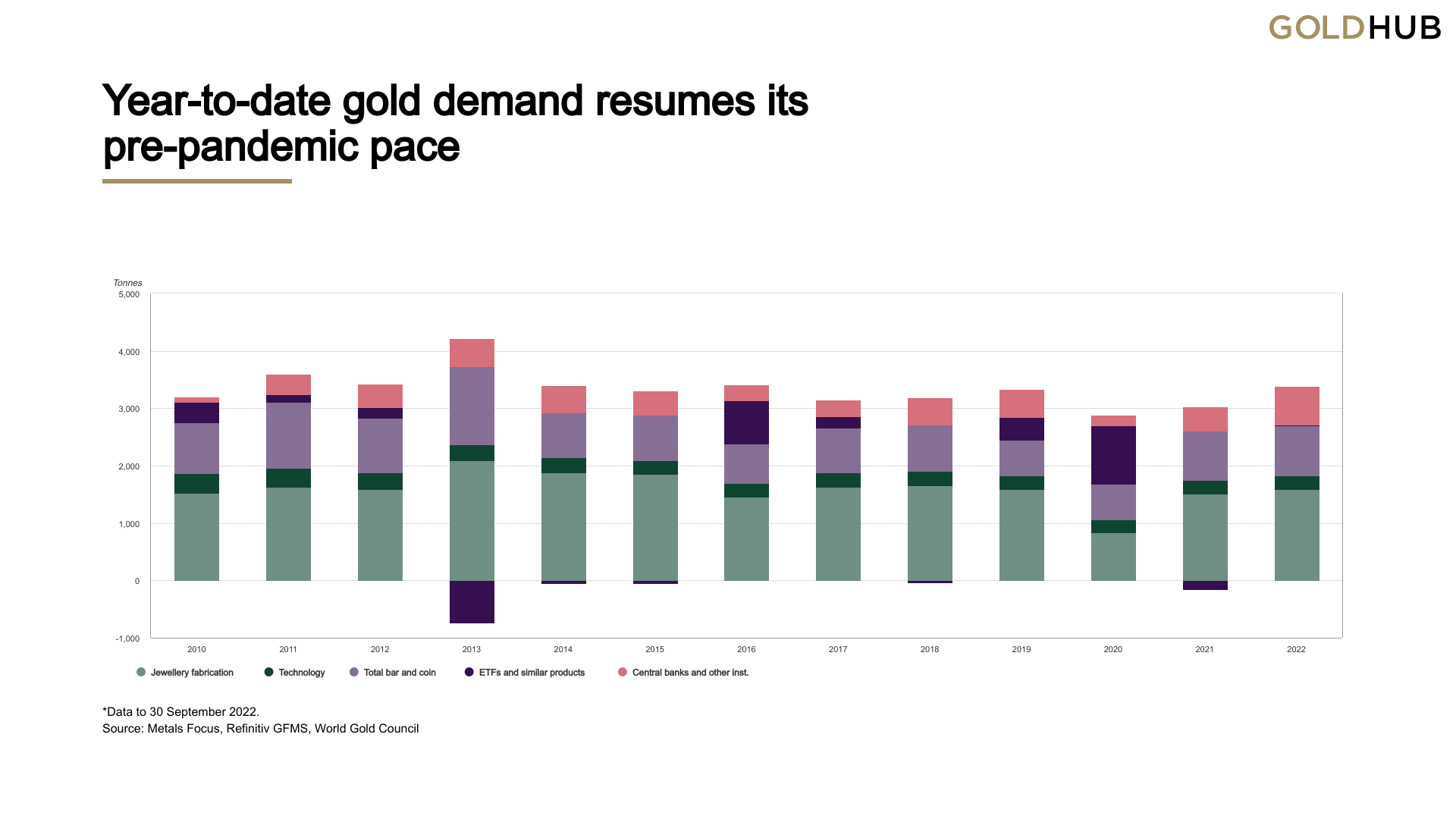

On Nov. 1, 2022, the World Gold Council (WGC) printed the group’s “Gold Demand Developments Q3 2022” report, which highlights the present developments tethered to gold and the valuable metallic’s markets in the course of the third quarter. WGC’s report, printed on gold.org, says the third quarter was wholesome and was pushed by “stronger client and central financial institution shopping for.” WGC highlights that these components helped year-to-date demand “get well to pre-Covid norms.”

“Gold demand (excluding OTC) in Q3 was 28% greater y-o-y at 1,181t,” WGC’s report notes. “Yr-to-date demand elevated 18% vs the identical interval in 2021, returning to pre-pandemic ranges.”

Whereas client demand for gold has risen, demand for gold from central banks has reached an all-time excessive, so far as central financial institution quarterly purchases are involved. The most important Q3 2022 patrons out of all of the central banks stemmed from Turkey, Uzbekistan, and Qatar.

“Turkey remained the biggest reported gold purchaser this yr,” WGC’s report particulars. ”It added 31t in Q3, lifting its gold reserves to 489t (29% of whole reserves). Yr-to-date it has added 95t to gold reserves.”

WGC researchers famous that Uzbekistan is steadily stacking gold because it bought 26 tons of the valuable metallic in Q3. The report explains that Uzbekistan has additionally been “a constant purchaser of gold” over the past two quarters.

The Qatar Central Financial institution secured a report buy when it purchased 15 tons of gold in the course of the third quarter. WGC says Qatar’s gold buy “seems to be its largest month-to-month acquisition on report again to 1967.”

The WGC report particulars that there are additionally central banks that aren’t reporting their gold acquisitions. “The extent of official sector demand in Q3 is the mix of regular reported purchases by central banks and a considerable estimate for unreported shopping for,” the WGC report claims.

Kazakhstan bought 2 tons of gold in the course of the third quarter, and the nation’s central financial institution was the biggest web vendor in Q3. WGC researchers say that “it isn’t unusual” for central banks “to swing between shopping for and promoting.” The WGC examine says that the official sector demand for gold confirms the findings from this yr’s annual central bank survey.

“The continued development of official sector demand for gold corroborates findings from our 2022 annual central financial institution survey, through which one-quarter of respondents said their intention to extend gold reserves within the subsequent 12 months (up from one-fifth in 2021),” the WGC researchers conclude within the central bank section of the report.

What do you consider the World Gold Council’s Gold Demand Developments Q3 2022 report? What do you consider the central financial institution’s quarterly purchases being essentially the most on report in Q3 2022? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, instantly or not directly, for any injury or loss prompted or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link