[ad_1]

This text is an on-site model of our Unhedged publication. Enroll here to get the publication despatched straight to your inbox each weekday

Good morning. The US inventory market didn’t blink finally week’s supposedly apocalyptic tech earnings. The S&P 500 was greater at its shut yesterday than it was every week earlier than. Evidently folks need some threat publicity going into this week’s Federal Reserve assembly. There are excessive hopes that Jay Powell will make a noise about slowing the tempo of charge will increase and even pausing them. We don’t know whether or not that can occur or not; we wouldn’t make these noises if we have been Powell, provided that “sticky” costs have hardly slowed; however we aren’t Powell. In any case, we lay out beneath a case that the markets are nonetheless sleeping on the Fed’s actual intentions, and the implications of these intentions. E-mail us: robert.armstrong@ft.com and ethan.wu@ft.com.

The bear case

Simply as with yesterday’s bull case, we don’t essentially endorse the entire arguments that observe. It’s an try to put out one of the best obtainable argument for trimming threat publicity proper now. Alert readers might sense that we’re extra sympathetic to the bears than the bulls; they are going to be proper. However we aren’t banging the desk (as a few of the arguments beneath may appear to do). We simply see an imperfect match between costs and what we see as probably the most unlikely coverage, financial, and behavioural outcomes over the following 12 months or so. So right here goes:

-

The market has priced in coverage charges starting to say no quickly after they peak, and that is most likely incorrect. Beneath is a chart of evolving market expectations for the tip of this 12 months (darkish blue), Could (crimson) and the tip of subsequent 12 months (gentle blue). We embrace Could as a result of that’s when the market expects to peak. What doesn’t make a great deal of sense is the concept that charges will fall between then and the tip of the 12 months. Sure, a recession subsequent 12 months is probably going (see beneath) and that recession will convey inflation down. However as Don Rissmiller of Strategas has identified, the Fed is not going to need to threat committing the errors of the late Nineteen Seventies and early Eighties, when charges have been introduced down too quickly, inflation jumped once more, and charges needed to be put again up. We may finish subsequent 12 months with charges nonetheless at their peaks.

-

Valuations, although they’ve fallen, simply aren’t that low cost. The S&P 500’s value/earnings ratio tells the story right here. We’re not wherever close to the lows of earlier main drawdowns, akin to 2001 and 2008. A lot of folks assume we want not strategy these lows, as a result of the recession, if there’s one, can be gentle. However that’s not an excellent wager (see beneath).

Others will have a look at the chart of cyclically adjusted P/E ratio (that’s, the S&P 500 value divided into 10-year common earnings) and level out that it’s bang at its common since 1995 (28). However a part of the explanation Cape valuations have been excessive for the reason that late Nineties is as a result of inflation has been very low and charges have been falling. That’s throughout now. Shares are usually not low cost.

-

That valuation level goes for company bonds too, by the way in which. Spreads are greater than they have been, however don’t value in a lot unhealthy information. Listed here are BBB spreads, that are proper at their long-term common:

-

There may be going to be a correct recession. The ten-year/3-month yield curve lately inverted (see chart beneath). Previously this has predicted recession all however infallibly. It is sensible that it ought to accomplish that. Such an inversion signifies that quick charges (which decide so many different costs within the financial system, from financial institution loans to mortgages) have been pushed in a short time to a stage above lengthy charges. Lengthy charges are a really tough approximation of a impartial rate of interest for the financial system. If quick charges are greater than lengthy, quick charges are restrictive; cash prices a lot it slows progress. The financial system’s parking brake has been yanked. A recession follows.

An argument is regularly made that this recession can be gentle as a result of shopper and company steadiness sheets are significantly sturdy proper now. Whereas steadiness sheet power would possibly cut back the probabilities of the sorts of monetary contagion that private bankruptcies and company defaults trigger, do not forget that financial coverage brings down spending by decreasing demand. Fed tightening will trigger family and company spending, and subsequently the financial system, to fall considerably. That’s what it’s designed to do, as a result of that’s what brings inflation down. A shallow or “technical” recession may solely outcome from completely calibrated coverage that the Fed has typically failed to attain prior to now.

-

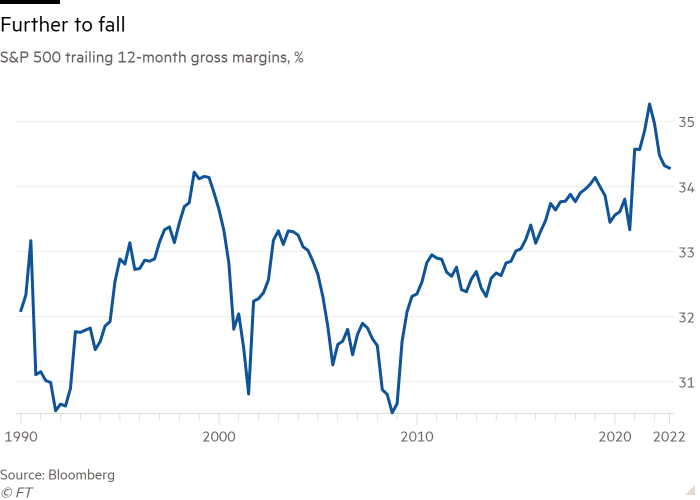

Margins have solely began to compress. The coronavirus pandemic-era mixture of rising enter prices, shortages and excessive demand have been a blessing for margins. Mark-ups surged as shoppers spent with out restraint and firms flexed their pricing energy. However falling demand and a list bulge are actually weighing on margins. And as Morgan Stanley’s Mike Wilson factors out, as we speak’s inflation is especially menacing for margins, with producers’ enter inflation falling extra slowly than shoppers’ value inflation. Margins, and earnings, are going to worsen.

-

Tina is toast. It was that you simply had to purchase shares as a result of the risk-free various, Treasuries, yielded nothing; therefore “There Is No Various”. That, too, is throughout now. Though falling inventory costs have pushed up their earnings yield, the yield differential between shares and bonds is shrinking.

-

Sentiment might have capitulated, however flows haven’t. Bulls make a giant to-do about poor investor sentiment. It’s poor, and that’s a opposite indicator. The thought is that we’re close to capitulation, that time the place all of the unhealthy information is inscribed within the value and the one strategy to go is up. However the poor sentiment has not, crucially, been accompanied by internet withdrawals from fairness funds, which makes it appear as if capitulation stays a way off. Beneath are internet flows into US fairness funds on a three-month rolling common foundation. They’ve solely simply touched zero because the extraordinary rush of cash throughout the pandemic has subsided.

-

Illiquid markets make for violent promoting. The sell-off in shares has been remarkably orderly up to now, and we’ve seen no sudden surge within the Vix. However as liquidity has dried up, different markets, like sovereign bonds or currencies, haven’t seemed so benign. Generally used indices for bond-market volatility (Transfer) and FX volatility (Cvix) are at decade-plus highs. Traditionally, FX volatility drives bond market volatility, which in flip creates tumult in equities, notes Michael Howell of CrossBorder Capital. Put one other method, the groundwork has been laid for panicky promoting ought to any additional shocks to equities, akin to earnings deterioration, happen.

If we’ve missed any brutally apparent factors, on the bear or bull side, do tell us. (Armstrong & Wu)

One good learn

Japan can, and should, defend the yen.

[ad_2]

Source link