[ad_1]

When Egypt was compelled to go cap-in-hand to the IMF because it struggled with a overseas foreign money disaster and dwindling reserves in 2016, President Abdel Fattah al-Sisi was adamant that he would take the “onerous selections” that his predecessors prevented to be able to flip around the ailing financial system.

Understanding he must push via politically delicate reforms that will heap ache on tens of millions of impoverished Egyptians to safe a $12bn mortgage from the fund, he insisted the Arab state needed to bridge the hole between assets and spending.

“We borrow and we borrow, and the extra we borrow the extra the debt grows,” Sisi mentioned. “All of the onerous selections that many through the years have been scared to take: I cannot hesitate for a second to take them.”

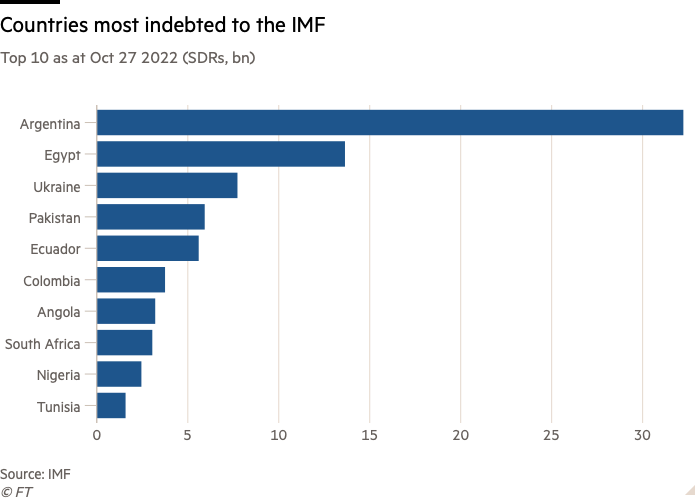

But six years on, Egypt is as soon as once more relying on IMF help because it grapples with one other overseas foreign money scarcity, with the fund agreeing final week to a brand new $3bn mortgage bundle. It’s the fourth time Cairo has sought the fund’s assist since Sisi seized energy in a coup in 2013, with Egypt holding the undesirable mantle of being the second greatest debtor to the IMF after Argentina. In whole, it owes multilateral establishments $52bn.

Partially, Egypt’s woes have underscored the vulnerabilities of poorer nations to the repercussions of Russia’s warfare in Ukraine after it triggered capital flight from rising markets and induced meals and vitality costs to soar — elevating import prices simply as an important supply of overseas foreign money dried up. However economists and Egyptian businessmen say that there are extra elementary points at stake, arguing that the worldwide disaster has magnified the fragility of Sisi’s state-driven financial mannequin.

Underneath Sisi’s watch, Cairo grew to become more and more depending on scorching cash flowing into home debt to finance its present account deficit because the central financial institution propped up the pound and saved rates of interest within the double digits. One result’s that Cairo had till not too long ago been paying the world’s highest actual rates of interest on its debt.

On the identical time, Sisi relied on the army to drive development because it was put accountable for scores of infrastructure initiatives and inspired to unfold its financial footprint throughout myriad sectors, from pasta to cement and drinks, crowding out the personal sector and dissauding overseas direct funding. The grievance is that the new cash was used to help large state spending, a lot of it via the army, that soaked up the overseas foreign money.

Now, the query Egyptian businessmen and analysts are asking is whether or not the shock of the previous six months might be ample to power Sisi to take arguably his hardest financial determination: rolling again the military’s function within the financial system. That, economists say, might be essential if the personal sector is to flourish and for the nation to draw higher ranges of FDI to herald extra sustainable sources of overseas foreign money.

“We have to cease the bleeding,” says a enterprise proprietor, who, like many others, needs to stay nameless given concern of repercussions in an autocratic state. “If we stock on this fashion it’s to the Paris Membership [for debt relief], haircuts, promoting property and in a state of chapter.”

Some businessmen cautiously hope that the rattled authorities has lastly woken as much as the precarious path the financial system was heading.

“It [the crisis] might be a blessing in disguise,” says one other govt. “There appears to be a consensus and an understanding that issues have to alter as a result of there’s no different options.”

Others stay cautious. If Sisi is to cut back the army’s footprint, the previous military chief might be taking up his core constituency and the nation’s strongest establishment with all its related vested pursuits.

“It is going to be very tough,” says the enterprise proprietor. “You give your child a toy and the way do you’re taking it away? It’s going to take loads of braveness to take again from the military and I fear about this. If you happen to assume privatisation within the public sector is tough, what a couple of army manufacturing unit?”

Jason Tuvey at Capital Economics says “the army will not be going to surrender its pursuits in a short time, and we now have to keep in mind the army could be very near Sisi, it might put stress on him if it feels its pursuits are coming below stress.”

Michael Wahid Hanna, an analyst at Disaster Group, says that lowering the function of the army “would require a rewiring and reordering of enormous elements of the financial system.” He provides: “And that’s onerous.”

The ‘disaster committee’

Egypt’s leaders have been jolted into motion virtually as quickly as Russians invaded Ukraine in late February as they braced for the worldwide repercussions of the battle. The regime swiftly established a “disaster committee” to satisfy weekly and targeted on guaranteeing meals safety for its 100mn inhabitants, tens of tens of millions of whom depend on subsidised bread.

The military was ordered to produce tens of millions of closely discounted “meals containers” to weak households, whereas officers sought to diversify sources of imports for the world’s high wheat importer. Earlier than Russian president Vladimir Putin launched his offensive, Egypt trusted Russia and Ukraine for about 80 per cent of its imported wheat, and the concern was that it will be one of many international locations most uncovered to produce shortages and will increase in meals costs.

“I fear about Egypt,” Kristalina Georgieva, managing director of the IMF, mentioned in March.

But it surely was not meals safety that will show to be the state’s Achilles heel. As an alternative, it was cautious overseas fund managers pulling about $20bn out of Egyptian debt in February and March, triggering the overseas foreign money disaster.

Sisi, who brooks zero dissent, was shocked to find the weaknesses within the system, folks briefed on authorities discussions mentioned.

On March 8, he jumped on a aircraft to Saudi Arabia, one in every of Cairo’s conventional backers, and by the tip of the month Riyadh had deposited $5bn in Egypt’s central financial institution. It was a part of a wider Gulf bailout, with the United Arab Emirates depositing $5bn and Qatar $3bn.

“I dread to assume,” says an Egyptian banker, when requested what would have occurred if the Gulf states had not ridden to Cairo’s rescue. “Sisi was very sad and it took him unexpectedly — the diploma of fragility within the monetary system.”

The three Gulf states additionally dedicated to investing billions of {dollars} to amass state holdings in Egyptian corporations via their sovereign wealth funds. Saudi Arabia’s Public Funding Fund and Abu Dhabi’s ADQ fund have already spent about $4bn this yr buying stakes in corporations, together with a financial institution, and chemical substances, fertiliser, logistics and tech corporations.

It was additionally in March that Cairo turned to the IMF for help, lastly sealing the $3bn mortgage final week. As well as, Egypt will obtain one other $5bn from multilateral and regional donors — more likely to be the Gulf states once more — this monetary yr, the fund mentioned.

Even officers are acknowledging that the disaster was a wake-up name.

A state official says that it was at all times the federal government’s aim to “unlock FDI”. However “perhaps folks received a bit relaxed and didn’t put the plan to work correctly.”

“Did we be taught from the lesson? Sure . . . the fellows on the central financial institution perceive it’s not straightforward cash,” says an Egyptian banker. “My feeling is, on the high, folks perceive we now have a problem, that problem is we overspent in a brief time period.”

However the crucial check might be whether or not the regime significantly addresses the overbearing dominance of the state within the financial system, significantly the army’s function.

“The basic downside is Egypt has been residing past its means. It produces and sells to the remainder of the world considerably lower than it imports, which it funds via debt,” says an Egyptian economist. “A variety of the state consumption comes outdoors the funds within the type of army funding. If you happen to have a look at loads of these megaprojects it’s the army financing it . . . they’re including to the import invoice and making a internet outflow of {dollars}.”

Rhetorically, not less than, the management has signalled it is able to act.

Talking to businessmen and authorities officers at an financial convention held earlier this month in response to the disaster, Sisi gave blended alerts, defending his report whereas additionally suggesting he was keen to cut back the state’s function.

“I solved the issue of the ports and of the infrastructure of the state differently. The route that you just advised providing [projects] to the personal sector and providing it to the foreigners, I’m with you, however I didn’t have the time for extra delays,” the president mentioned. “Are state corporations on supply [for sale]? Sure . . . . By God, by God, by God all the businesses of the armed forces are with you [available for sale].”

Two months earlier, Sisi had accepted the resignation of central financial institution governor Tarek Amer, who many criticised for his function within the malaise.

“The governor was very near the military and was satisfying all of the army’s wants with no strings connected,” says the Egyptian govt.

The central financial institution has since mentioned it will enable a versatile trade regime, one thing the fund was demanding. The mortgage bundle was meant to assist Egypt “push ahead deep structural and governance reforms to advertise personal sector-led development and job creation,” the IMF mentioned.

Way back to April, Sisi had introduced that the federal government would increase $40bn over 4 years via the sale of state property and mentioned it will begin promoting stakes of army corporations on the inventory trade “earlier than the tip of yr”. In the identical speech, he additionally known as for “political dialogue” with youth actions and political events, a shock transfer for a president who presides over a regime that has jailed tens of 1000’s of individuals and is accused of being Egypt’s most oppressive in many years.

Hanna, the Disaster Group analyst, says whereas the dialogue is proscribed in nature, the regime is “performing some issues we didn’t assume potential not so way back”.

“There’s loads of scepticism and frustration with it, and considerations that it’s a PR train,” Hanna says. “But it surely’s reflective of the very fact there’s stress; they recognise this second is totally different and they should reply in another way.”

The federal government can be engaged on a “state-ownership” doc meant to stipulate sectors wherein it envisages a task for state entities, together with the army, and the place their presence needs to be lowered or utterly withdrawn.

In drawing up its plans, the federal government has engaged with the IMF, the World Financial institution and businessmen because it targets greater than doubling the personal sector’s function within the financial system to 65 per cent over the subsequent three years. However months after the initiative was first introduced, the ultimate doc has not been revealed. Sisi has beforehand made pledges to sell-off stakes in army corporations over the previous three years, however the rhetoric has but to be matched by asset gross sales on the bottom.

“It’s a tough factor to unwind; it will be in a way a significant ideological reversal,” Hanna says. “Throughout the Sisi period, army privilege has elevated; their function within the financial system has elevated and that has created actual winners, together with throughout the army and former army. It’s its personal sort of patronage.”

Leaning on the army

Sisi has relied on the army because the prime car to drive his financial plans since he inherited a damaged financial system after ousting Islamist chief Mohamed Morsi, the nation’s first democratically elected president, 9 years in the past.

His authorities earned plaudits from the IMF, businessmen and bankers in 2016 after pushing via robust reforms, together with slashing vitality subsidies and trimming the state’s wage invoice, to safe that yr’s $12bn mortgage and convey fiscal stability. It additionally allowed the pound to devalue, with the foreign money shedding half its worth that yr.

Nevertheless, the regime did little to enhance the funding local weather in a rustic lengthy blighted by an unwieldy paperwork, poor logistics and corruption, businessmen and economists say.

As an alternative, the president cast forward with an estimated $400bn value of infrastructure initiatives as he promised to construct a “new republic”. Because the nation morphed from being a police state to a military-led state, the military prolonged its attain throughout the financial system, from metal and cement to agriculture, fisheries, vitality, healthcare, meals and drinks.

The financial system went on to put up among the area’s highest development charges, however economists cautioned that it was primarily pushed by development, the vitality sector and actual property. Whereas among the infrastructure initiatives have been deemed essential, critics view others as vainness initiatives that the nation might ill-afford. Poverty charges rose after the devaluation and personal sector funding remained beneath historic averages.

Many businessmen who had welcomed Sisi’s coup for returning a semblance of stability to the nation, additionally consider he entered workplace suspicious and disdainful of the personal sector. Because the army’s presence within the financial system expanded, whispered considerations grew that it was laying aside each native and overseas funding.

The difficulty was not simply the size of the army’s ever rising attain, however concern amongst businessmen that they might get up and discover themselves competing with an untouchable establishment that controls a lot of Egypt’s land, can use conscript labour and is exempt from some taxes.

Two years in the past, there have been tentative indicators that the regime was starting to hearken to companies’ considerations when the Sovereign Fund of Egypt was tasked with promoting stakes in 10 military-owned corporations. It recognized two, Wataniya, which operates about 200 service stations, and Safi, a water bottling and meals firm, as the primary property it will privatise however neither has been sold-off.

Ayman Soliman, the fund’s chief govt, says there’s a “slew” of corporations prepared for an inventory, including that the fund was corporatising the businesses to get them prepared on the market, both via listings or promoting stakes to strategic traders pre-IPO.

“The programme hasn’t modified, however as we construct our studying curve, we’re educating our counterparts; we’re constructing a street map,” says Soliman. “We’ve had corporations earmarked for IPO for lengthy, however there’s no market on the market even when you’ve got one of the best product.”

He says state-owned entities being lined up for privatisation additionally contains these in monetary companies, infrastructure, vitality and agriculture.

However even when the regime is severe about promoting off army corporations, it should face myriad challenges attracting traders, specialists say. And economists warning that asset gross sales alone won’t remedy Egypt’s deep issues because the social, financial and demographic pressures mount, with an estimated 60mn Egyptians residing beneath or simply above the poverty line.

The regime’s precedence through the previous 9 years has been sustaining social stability and crushing dissent to stop any repeat of the 2011 well-liked rebellion that toppled former president Hosni Mubarak. It has ruthlessly muzzled any trace of unrest.

Many Egyptians who bear in mind the chaos that got here within the wake of the revolution have additionally been cautious of both taking up the regime or triggering instability. However the latter sentiments might dissipate over time, specialists say.

“The youthful folks, who’re 18, 19, 20, hardly bear in mind the revolution, they don’t bear in mind the chaos [that followed], in order that institutional reminiscence fades over time and other people will grow to be extra keen to rock the boat when they’re impoverished,” says the Egyptian economist. “So there’s a finite time interval while you might be complacent concerning the threat that prime discontent will result in political instability.”

In principle, these considerations ought to immediate the regime to behave. However others fear that complacency might set in with the assumption that Egypt is just too vital geopolitically to be allowed to fail, and that it will probably depend on bailouts from its neighbours.

Sisi himself warned on the convention final week concerning the threat of relying too closely on its Gulf allies. “Even the brothers and mates, they’re now satisfied that the Egyptian state is unable to face up once more and that years of help and assist has led to the creation of a tradition of dependency on them to resolve crises and issues,” he mentioned.

“We consider on this fiction we’re too massive to fail, that’s not true. For them [Gulf donors], failure is the Muslim Brotherhood taking on once more,” says an Egyptian educational. “In need of this, there are all kinds of disasters that may occur which our brother Arabs can fortunately dwell with . . . [Egypt] stagnant, impoverished and getting worse and worse.”

“The disaster acts as a wake-up name,” he provides. “However will they get up in the appropriate place?”

[ad_2]

Source link