[ad_1]

The European Central Financial institution’s quarterly Bank Lending Survey this week failed to draw a lot consideration, which is not any shock. Headline findings — that European lenders count on to tighten credit access this quarter as increased rates of interest weigh on demand — had been hardly stunning information.

However take a dig by way of the small print and it turns into apparent how quickly credit score situations are deteriorating, which makes predicting one side of Thursday’s ECB meeting unusually difficult.

Lending requirements for European non-financial firms have returned to peak eurozone-crisis ranges, with Italian debtors hardest hit. Mortgage lending and client credit score are as tight as they had been in 2008, led by a squeeze in Spain and Germany.

Company mortgage demand has been saved artificially excessive this yr by sluggish provide chains and rising manufacturing prices. That impact now seems to be to be fading . . .

… however for households the crash in demand seems to be properly superior:

The ECB lenders’ survey sometimes foreshadows downstream credit score provide by about a year. The tempo of withdrawal seen since June, when the ECB flagged the end of negative rates, “corroborates our view that the euro space is headed in direction of a pointy recession”, mentioned Barclays.

As a result of lending requirements fluctuate between international locations — formed by employment markets and sovereign-bank relationships — the financial-industry response has been uneven. Lenders in Spain, Austria and Belgium have been tightening credit score way more than these within the Netherlands, Eire and France. Charts by way of Redburn:

A worsening macro atmosphere with increased charges (therefore refinancing challenges for debtors) recommend a European financial institution value of danger that’s greater than double the 0.40 foundation factors at present assumed by the market, Redburn estimates.

Doubling the price of danger would transfer the sector’s valuation again to its long-term common of 10 instances ahead earnings, versus its ostensible bargain-basement degree of 6x at present. Neither ratio deserves a lot consideration as they’re simply snapshots, not guides. The place cost-of-risk ultimately peaks will rely largely on how a lot unemployment climbs. And at in the present day’s costs, traders appear to be assuming it’ll rise by not more than a few share factors.

For that purpose, it’s helpful to take a granular view of European unemployment expectations. Employers within the Netherlands and France seem optimistic; these in japanese Europe, Italy, Germany and Belgium don’t:

All of which will be placed on a scatter plot:

We’re reminded often that within the common mountain climbing cycle, the margin increase that banks get from rising rates of interest tends to eclipse weaker mortgage development. However a deeper recession additionally means banks must work tougher to acquire wholesale funding, round which there are already some indicators of decay:

One other factor to recollect is that capital buffers throughout the European banking sector are ridiculously fats:

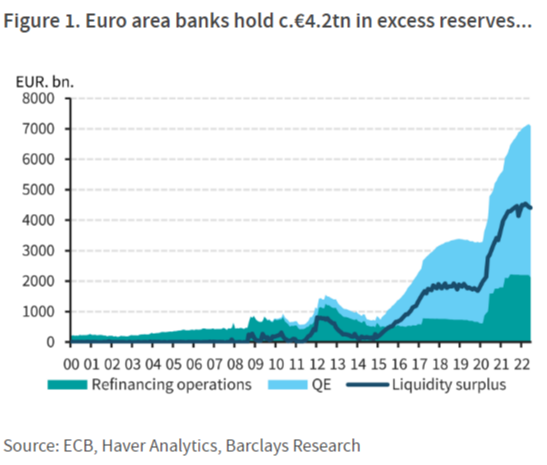

Nonetheless, indicators of tighter wholesale funding are badly timed for the ECB, which must cut back its pandemic-era mortgage subsidy often called focused long term refinancing operations. Banks can borrow by way of the TLTRO virtually for nothing then park their extra liquidity on the ECB’s in a single day deposit facility, which pays 0.75 per cent in the mean time.

About €1.1tn of the €2.1tn in excellent TLTRO loans have been used for ECB deposit arbitrage, Barclays estimates. Conserving the scheme in present kind at increased charges would imply the ECB pays round €110bn to euro space banks over the following 12 months, for little or no purpose.

However with two-thirds or thereabouts of TLTROs repayable within the first half of 2023, a full withdrawal would symbolize a cliff-edge danger for periphery economies particularly:

The ECB would possibly scale back the attractiveness of TLTRO arbitrage by repricing excellent loans to match its deposit fee. Or it would apply some form of tiering threshold on parked reserves. The straightforward approach to method tiering could be to exempt a share of TLTRO borrowing from deposit curiosity — however that may throttle liquidity in Italy and Spain, in addition to creating little or no incentive to pay loans again.

A tricksier resolution could be to keep away from direct motion, and use Swiss National Bank-style reverse-tiering, whereby deposit curiosity will now not be paid on liquidity in extra of some arbitrary threshold. Overfunded banks could be inspired to pay again their TLTROs to keep away from the efficient penalty, whereas underfunded ones would nonetheless have entry to the carry commerce.

Right here’s how that appears throughout the zone with the brink set at 6 instances minimal required reserves, and once more at 25 instances.

Too sophisticated? Too political? Proper now, given every little thing, in all probability. So analysts count on nothing extra this week than some gentle tweaking of the deposit phrases and situations. Right here’s Barclays:

We predict the ECB is more likely to intervene instantly as reverse-tiering would carry a larger danger of impairing the transmission of financial coverage. With circa 65 per cent of TLTRO borrowing set to mature by June 2023, which can scale back the liquidity surplus, we predict the least disruptive technique for the ECB could be to easily wait.

[ad_2]

Source link