[ad_1]

Whereas the worth of bitcoin has remained vary sure and coasting alongside simply above the $19K zone, over 60% of the bitcoin in circulation has not moved in a 12 months or extra. Furthermore, there’s been only a few transfers from bitcoins stemming from 2010, and it’s been greater than two months for the reason that final 2010 block subsidy switch. In the meantime, 2011 block subsidy transactions have appeared now and again, and on October 25, 2022, roughly 92.76 bitcoin value roughly $1.79 million from 2011 have been transferred to unknown wallets.

2010, 2011 ‘Sleeping Bitcoin’ Spending Slows — 92 Bitcoin From 2011 Transferred on Tuesday

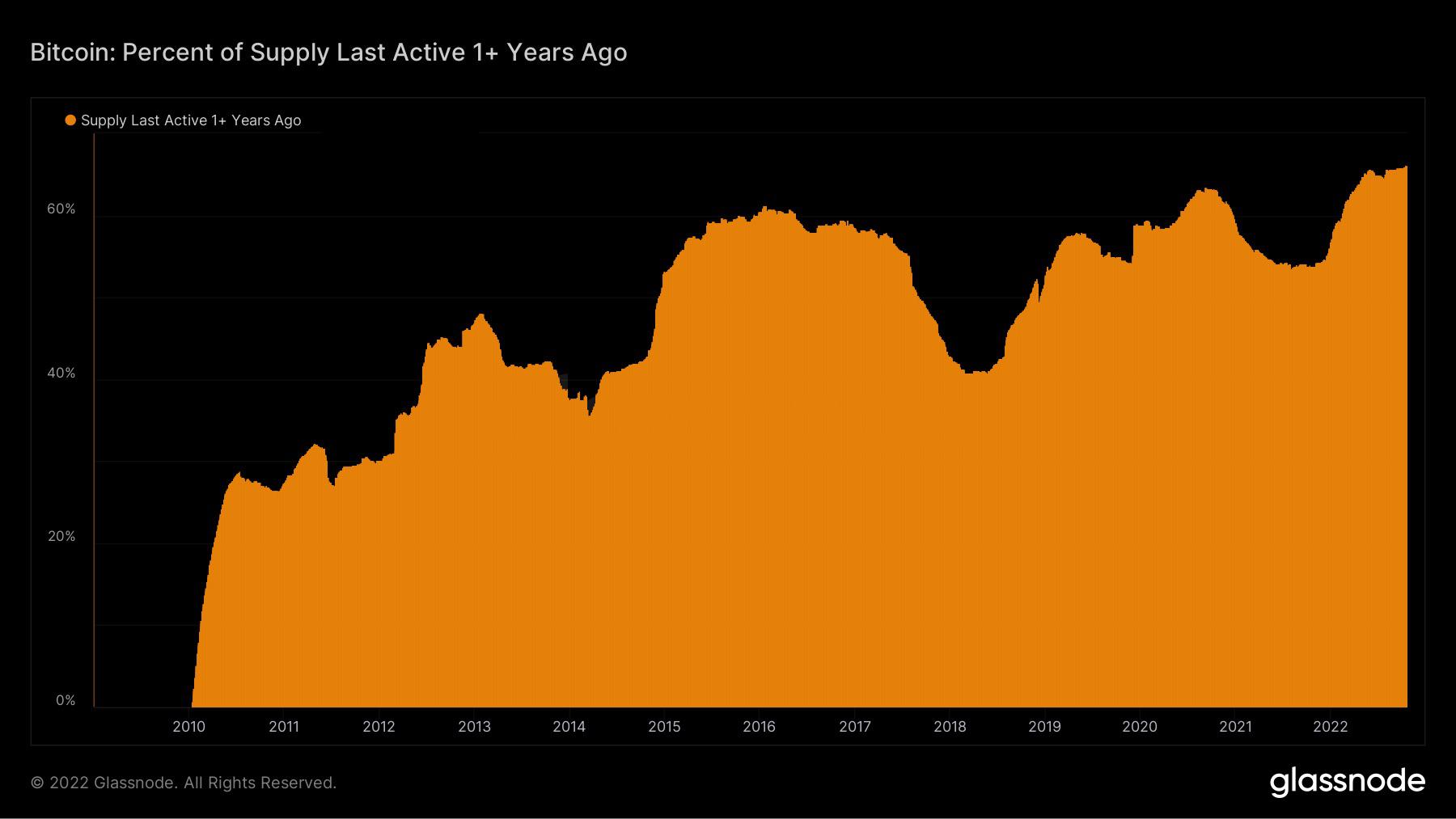

On October 24, bitcoin supporters celebrated the variety of bitcoin (BTC) that haven’t moved in a 12 months or extra. The bitcoiners shared a chart from Glassnode that signifies greater than 60% of the BTC in circulation has not moved in a 12 months or extra.

Bitcoin.com Information has additionally observed that the variety of so-called ‘sleeping bitcoins’ transferred in 2022 has slowed down an awesome deal for the reason that all-time BTC value highs on the finish of 2021. As an illustration, knowledge from January 2021 to September 28, 2021, had proven 152 transactions derived from ‘sleeping bitcoins’ from 2010.

The identical analysis had proven from January 2021 to September 2021, 85 transfers from 2011 ‘sleeping bitcoins’ occurred. Furthermore, whereas bitcoin (BTC) moved towards its $69K all-time excessive, hundreds of millions of {dollars}’ value of ‘sleeping bitcoins’ have been transferred in mid-November 2021.

This 12 months, nevertheless, the variety of ‘sleeping bitcoins’ from 2010 was solely 12, and the variety of 2011 transactions added as much as solely 30 transfers. Moreover, it’s been roughly 64 days for the reason that final 2010 BTC spend that occurred on August 22, 2022.

Nevertheless, there’s been a complete of ten 2011 transactions since then, with two transfers spent on Tuesday, October 25, 2022. On Tuesday, 42.76 BTC were transferred to an unknown deal with and spent at block peak 760,212.

It’s value noting that the phrases “spent” or “spend” on this article, don’t essentially imply that the bitcoins have been “bought” to a 3rd get together for fiat or one other crypto asset. After the 42.76 BTC spend, seven block subsidies later at block peak 760,219, roughly 50 BTC were transferred to an unknown deal with.

Between the 42.76 BTC and the 50 BTC moved on Tuesday, the stash was value 1.79 million nominal U.S. {dollars} utilizing right now’s BTC trade charges. Whereas October isn’t over but, September and October haven’t seen any 2010 spends in any respect, however a complete of 9 2011 transfers have occurred in the course of the two-month span.

Whereas 2022 has had a complete lot much less spending from 2010 and 2011, the 12 months did present some transfers sorts that had not occurred since Could 2020. This 12 months, a complete of 5 block subsidies or roughly 250 BTC mined in November 2009, have been transferred.

The latest knowledge from Glassnode exhibits that greater than 60% of the BTC in circulation has not moved in a 12 months or extra, and the less 2010 and 2011 transfers suggests BTC house owners are ready for the bear market to finish earlier than shifting outdated cash. A fantastic majority of the outdated ‘sleeping bitcoins’ that moved in October have derived from cash and block subsidies from 2012, 2013, 2014, 2015, 2016, and 2017.

What do you consider the slowing pattern of 2010 and 2011 ‘sleeping bitcoin’ spends? Tell us your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons, Btcparser.com,

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link