[ad_1]

Taiwan greeted Nancy Pelosi as a real pal when the US Home Speaker visited the nation in August in what was seen as an indication of help towards Chinese language army threats.

However when President Tsai Ing-wen hosted Pelosi for lunch at a neo-baroque palace in Taipei, two males on the desk had been a reminder that the friendship is coming beneath pressure: Morris Chang, founding father of Taiwan Semiconductor Manufacturing Firm, and Mark Liu, chair of the world’s largest contract chipmaker.

The worldwide semiconductor trade is now dominated by Taiwan, due to TSMC’s meteoric rise. Chang instructed Pelosi in stark phrases that Washington’s efforts to rebuild chip manufacturing at residence had been doomed to fail.

“He was fairly blunt, and the esteemed visitors had been a bit shocked,” says one one that heard the dialog.

TSMC now finds itself on the centre of each a tug of conflict between Washington and Taipei and the fiercest entrance within the new chilly conflict between China and the US.

Nicknamed the “godfather of the chip trade” in Taiwan, 91-year-old Chang is defending his life’s work: based 35 years in the past with start-up capital from the Taiwanese authorities and know-how licensed from Dutch semiconductor firm Philips, TSMC has grown into a large with an efficient stranglehold on the worldwide chip provide chain.

Taiwan sees this dominance as an important safety assure — typically known as its “silicon defend”. The federal government believes that the focus of worldwide semiconductor manufacturing within the nation ensures the US would come to the rescue if China had been to assault.

“Everybody wants extra superior [ . . . ] semiconductors,” financial system minister Wang Mei-hua said during a visit to Washington this month. Being a key world participant on this means will “make Taiwan [ . . . ] safer and [secure] peace”, she added.

However Taiwan’s dedication to maintain as a lot of the trade as it may possibly on the island is clashing with US strategic objectives and its fears of China.

As competitors between the US and China heats up and the chance of a army battle over Taiwan will increase, Washington is looking for to each lower Beijing off from provides of key superior semiconductors and scale back its personal dependency on Taiwan for chip provides.

Each of these targets doubtlessly undermine TSMC, whose success is constructed on serving clients in all markets and on doing so from a cost-efficient cluster of vegetation nearly solely in Taiwan.

“The silicon defend is turning into a tripwire,” says Jason Hsu, a former Taiwanese lawmaker and now a senior fellow on the Harvard Kennedy College.

“On the one hand, the US pressures TSMC to maneuver to the US. On the opposite, it’s waging technology war on China, pushing rigidity to the next stage that places Taiwan in danger,” he provides. “You probably have one thing that either side need, you’ve got leverage. However for those who don’t play that card, you change into a pawn. We’re sort of enjoying together with what the US desires.”

The US stepped up its marketing campaign to hamper China’s financial system earlier this month, introducing sweeping controls that block exports of some chip manufacturing tools and limit gross sales of sure semiconductors to the nation — measures clouding the way forward for China’s whole chip trade.

Though TSMC says the affect on its enterprise is proscribed for now, chief government CC Wei instructed traders it was too early to evaluate the true affect in the long term.

The issue for TSMC is that Washington is concurrently pushing to diversify chip manufacturing away from Taiwan.

The Pentagon has lengthy been involved that US dependency on Taiwan might put its defence trade’s chip provides in danger. Final yr, Eric Schmidt, the previous Google CEO who chaired a nationwide fee on synthetic intelligence, mentioned the US was “very near shedding the chopping fringe of microelectronics which energy our firms and our army due to our reliance on Taiwan”.

Now, the chip scarcity triggered by disruptions in the course of the pandemic, Washington’s need to decelerate China in its pursuit of know-how management, and fears that Beijing might seize Taiwan by power are all catalysing US efforts to revive semiconductor manufacturing at residence. Europe, Japan, Singapore and India are making comparable efforts.

Carrying his trademark aviator sun shades on a shiny Ohio day in early September, President Joe Biden bragged that “America is again” as he attended the groundbreaking ceremony for a $20bn chip fabrication plant, or “fab”, that Intel will construct.

“Of us, the way forward for the chip trade goes to be made in America,” Biden mentioned, one month after the US Congress handed laws to supply $52bn to assist rebuild US semiconductor manufacturing.

The geopolitical and enterprise implications of the brand new US technique are beginning to change into obvious. “Everybody realises that there’s a large watershed second right here for the entire trade,” says Peter Hanbury, a accomplice and skilled in semiconductor and know-how provide chains at Bain, the consultancy. “Nevertheless it sort of snuck up on folks.”

World domination

The relentless rise of TSMC is among the most vital and least instructed chapters within the period of globalisation.

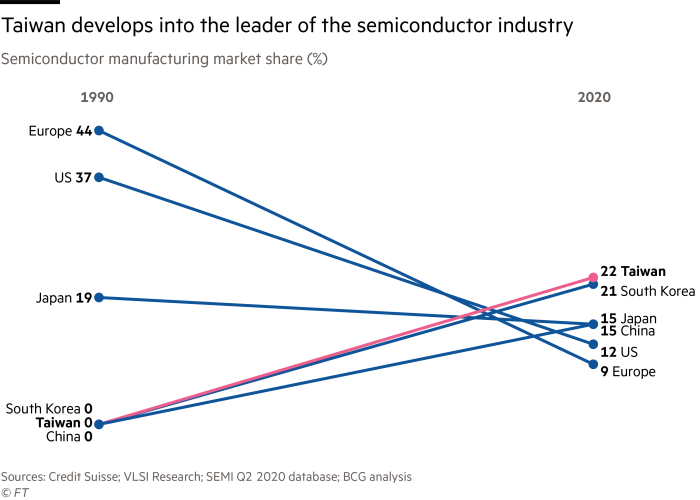

Totally different from friends corresponding to Intel and Samsung, which proceed to each design and manufacture chips, TSMC is a contract producer that produces semiconductors designed by different firms. The effectivity and price financial savings of this foundry mannequin have satisfied so many different chipmakers to outsource fabrication to TSMC that Taiwan now accounts for 20 per cent of worldwide wafer fabrication capability, the one largest focus in a single nation, and a staggering 92 per cent of capability for essentially the most superior chips. The US share in world chip manufacturing has dwindled from 37 per cent in 1990 to 10 per cent in 2020.

The dangers are clear: Credit score Suisse analysts estimate that if the world had been to lose entry to Taiwan’s chip vegetation, the manufacturing of all the pieces from computer systems to automobiles can be severely disrupted.

A serious disruption in that capability can be “large” in contrast with latest incidents corresponding to a 2021 outage in a Samsung fab attributable to energy cuts in Texas, Covid-related disruption in south-east Asian factories and earthquakes in Japan, in line with Credit score Suisse. TSMC’s capability footprint by the top of 2023 might attain $171bn, “over 3x the size of the US Chips Act allocations by the following decade”, it provides.

Breaking apart this hub challenges not solely TSMC however the world ecosystem that has fashioned across the firm.

Chang began TSMC in 1987 after the Taiwanese authorities recruited him from the US to assist create an electronics trade. Business executives credit score the corporate’s success to its single-minded give attention to technological element, buyer wants and execution.

Chang began honing these expertise when semiconductors had been nonetheless of their infancy. Born in China and educated as an engineer at MIT, he started working alongside the pioneers of the trade within the Nineteen Fifties and confirmed his knack for bettering manufacturing processes from the very starting.

At US chipmakers Sylvania and Texas Devices, Chang turned an skilled in growing the yield — the proportion of non-defective transistors on a manufacturing line — in line with Chris Miller, an financial historian at Tufts College and creator of Chip War, a e book in regards to the trade. That turned a core power that reinforces each TSMC’s income and reliability for its clients.

TSMC’s foundry providers spawned a whole new breed of “fabless” chip firms, corresponding to Nvidia, the graphics chip design home based in 1993. The growing technical issue of chip manufacturing and the ballooning price of constructing fabs additionally satisfied ever bigger numbers of chipmakers to go fabless.

One among them was AMD, Intel’s rival out there for central processing items, the chips that energy PCs. After falling behind Intel, AMD bought its fabs in 2008. It now depends nearly fully on TSMC, a method that helped it get better.

The subsequent enhance got here when Apple began designing chips for the iPhone in-house and picked TSMC to fabricate them. Its iPhone chips at the moment are solely made by TSMC in Taiwan.

“I’ve been shocked by Apple and AMD deciding to permit themselves to get so reliant on one provider,” says Dan Nystedt, vice-president at TriOrient, an Asia-based personal funding firm. “That’s dangerous. Even with out geopolitics, there are earthquakes, energy shortages. Why does Apple settle for that their complete firm must shut down if TSMC had been shut down?”

Some fabless firms’ choice to place all their eggs in a single basket displays the effectivity of the symbiotic system TSMC has constructed.

“There was an unwillingness to even take into consideration shifting away from TSMC for lots of the trade [because] it was inconceivable for the enterprise mannequin that was functioning so nicely,” Miller says.

TSMC was additional strengthened when Intel stumbled. The corporate, lengthy centered on CPUs, missed each the rise of the smartphone and of synthetic intelligence functions, letting TSMC seize a lot of the marketplace for chips utilized by cloud providers suppliers corresponding to Google. Then Intel struggled to grasp mass manufacturing in two consecutive course of know-how generations. This allowed TSMC to tug forward not solely in scale but in addition in know-how.

“That, mixed with the geopolitical rigidity, led to a disaster of confidence within the US: if one thing had been to go fallacious within the Taiwan Strait you might not credibly inform your self that you might depend on US know-how solely to construct up the capability you want if, actually, by some key metrics TSMC had leaped forward of Intel when it comes to know-how,” Miller says.

By the point Barack Obama ready handy the presidency over to Donald Trump, issues over the US’s heavy dependence on Taiwan-made chips had unfold from the Pentagon to the commerce division.

Though it took a commerce conflict with China, a pandemic and an escalation in China’s threats towards Taiwan, Washington is now shifting rapidly. In 2019, Trump administration officers leaned on TSMC to put some superior capability within the US, its largest market.

The corporate complied — it’s constructing a fab in Arizona that’s scheduled to begin mass manufacturing in 2024.

However the plant has neither the size nor the technological stage of TSMC’s latest fabs — in Taiwan, the corporate is constructing a fab for N2 chips, the latest era of chips that’s anticipated to comply with the N3 one about to enter mass manufacturing.

“Progress on lowering the dependence on TSMC . . . for essentially the most superior processes is not going to be diminished considerably till TSMC, Samsung and Intel all website superior services at scale within the US,” says Paul Triolo, a China and know-how skilled at Albright Stonebridge Group.

Even then, solely a part of the availability chain will profit. The fabs that Intel, TSMC and Samsung are constructing within the US are all for superior chips, so they may principally help the PC, smartphone and server trade. Nonetheless, automakers, which noticed manufacturing disrupted attributable to chip provide bottlenecks, use much less superior chips that battle to be viable within the US, the place prices are larger.

“A variety of the funding is not going to assist with the defence provide chain both,” says Hanbury. “The one authorities functions that run on superior nodes are AI, cryptography and supercomputers, and people account for lower than 5 per cent of bleeding-edge chips.”

An uphill battle

Regardless of Biden’s upbeat rhetoric, the Chips and Science Act could fall far quick of what’s wanted.

“The way in which the fab funding part has advanced and is now enjoying out is a prepare wreck ready to occur,” says Dick Thurston, former normal counsel for TSMC and now a guide within the US. “There will likely be loads of disillusionment — really, US semiconductor manufacturing will undergo due to it. To ensure that this to succeed, you want a number of multiples of the cash dedicated over a interval of 10 to fifteen years at the least.”

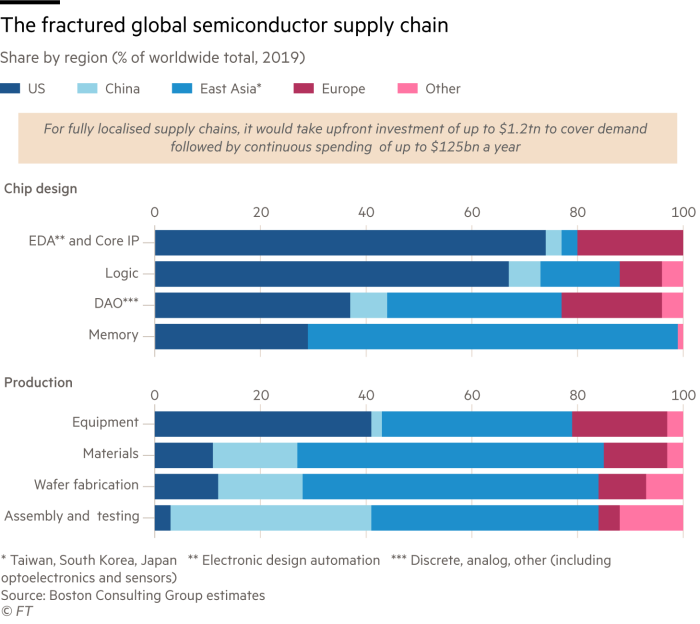

Underlining the dimensions of the problem, the Semiconductor Business Affiliation and Boston Consulting Group estimate that upfront investment of up to $1.2tn can be wanted for every area to have absolutely localised provide chains at 2019 ranges, adopted by steady spending of as much as $125bn a yr.

Edlyn Levine, chief science officer at America’s Frontier Fund, which goals to put money into firms that may assist the US keep forward in vital applied sciences, says it’s “a fantasy” to suppose that the US might fully decouple from TSMC. “The thought . . . is technically not possible,” says Levine.

Regardless of its Arizona funding, TSMC is attempting to take a seat issues out because the focus of its fabs and suppliers in a good cluster in Taiwan has enhanced its effectivity. “There are loads of advantages to the best way they’re working issues — particularly the shut connection between R&D and high-volume manufacturing the place you’ll be able to ship an engineer to a fab simply an hour away,” Hanbury says. “The price financial savings and advantages of experience are a part of the TSMC mannequin.”

The corporate refuses to debate how the push for change impacts it. “We recognise that there was elevated consideration on geopolitical points between China and Taiwan, which aren’t new and return many years,” says TSMC. “Nonetheless, we don’t see these tensions affecting TSMC operations on the present time. The present plan of TSMC operations can also be sustainable in Taiwan. The success and functioning of the extremely advanced and various semiconductor ecosystem require world collaboration, as all nations and corners of the know-how trade know.”

Nonetheless, the heightened sensibility over world dependence on Taiwan is for certain to power change.

“There have been some issues amongst TSMC clients since two years in the past,” says Sebastian Hou, managing director at Neuberger Berman, an funding administration firm. “It was the time when in Taiwan we began to have extra fighter jets from China hovering across the Taiwan Strait, and that has change into a day by day routine.”

Wi-fi chip firm Qualcomm mentioned in August it was greater than doubling manufacturing orders to GlobalFoundries beneath a strategic co-operation with the TSMC rival, particularly at a plant the foundry is increasing in New York.

Nvidia is splitting its product portfolio with knowledge centre chips being produced at TSMC and a few of its private gaming chips by Samsung.

Hanbury says it can take years to see whether or not extra TSMC clients comply with that instance as a result of altering manufacturing companions is so tough and dangerous. “The large query is that if Apple can also be going to do a cut up,” he provides.

A decisive issue will likely be how easily TSMC’s rivals can scale up capability within the US. Each Intel and Samsung are planning a lot greater US fabs than TSMC’s preliminary Arizona dedication, theoretically permitting for a greater price construction and market share positive factors. Nonetheless, TSMC has acquired sufficient land to construct a number of extra fabs.

Business specialists consider that diversifying its footprint would possibly change into vital for TSMC for causes past geopolitics. It’s already getting tougher for the corporate to seek out the hundreds of engineers for its bigger and bigger fabs. One other query is whether or not Taiwan will be capable to present sufficient water and energy to maintain increasing chip manufacturing.

Some analysts argue that Taipei’s reliance on TSMC for its safety is flawed within the first place.

Brad Martin, director of the Nationwide Safety Provide Chain Institute on the Rand Company, warns that as an alternative of functioning as a “silicon defend”, Taiwan’s dominance within the semiconductor market might make it extra weak.

If China had been to impose a quarantine — a restricted, non-violent blockade — on Taiwan, different nations might shrink back from supporting the nation out of concern that an escalation would result in completely chopping off and even destroying their chip provides, Martin says.

“The monopoly in semiconductor manufacturing creates instability,” he provides. “If the US is confronted with a have to decide between defending its financial system and defending Taiwan, that begins to change into a really stark choice.”

[ad_2]

Source link