[ad_1]

Although bitcoin miners are getting naked minimums in income per petahash per second (PH/s), and the myriad of headlines exhibiting particular mining operations folding from the crypto winter, the community’s complete hashrate continues to chug alongside at near 300 exahash per second (EH/s). With decrease bitcoin costs and the mining problem at an all-time excessive, the present tendencies haven’t pushed bitcoin miners again within the least. In the meantime, the subsequent problem retarget scheduled to happen on or round October 23, reveals one other enhance will happen.

Bitcoin’s Hashrate Stays Excessive Regardless of Present Obstacles

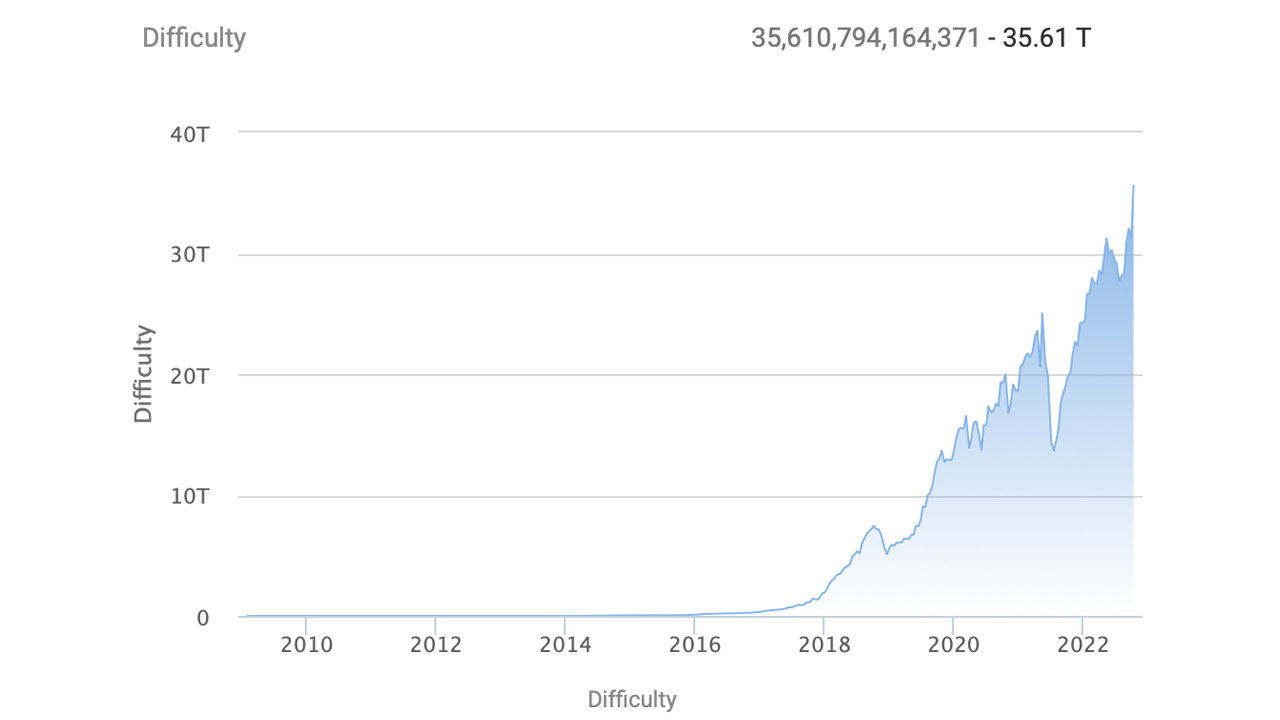

With lower than two days left, it appears as if bitcoin (BTC) miners will get one other upward enhance by way of the community’s problem. At present, Bitcoin’s problem is at an all-time excessive (ATH) at 35.61 trillion and the subsequent change is scheduled to occur in lower than two days on or round October 23, 2022.

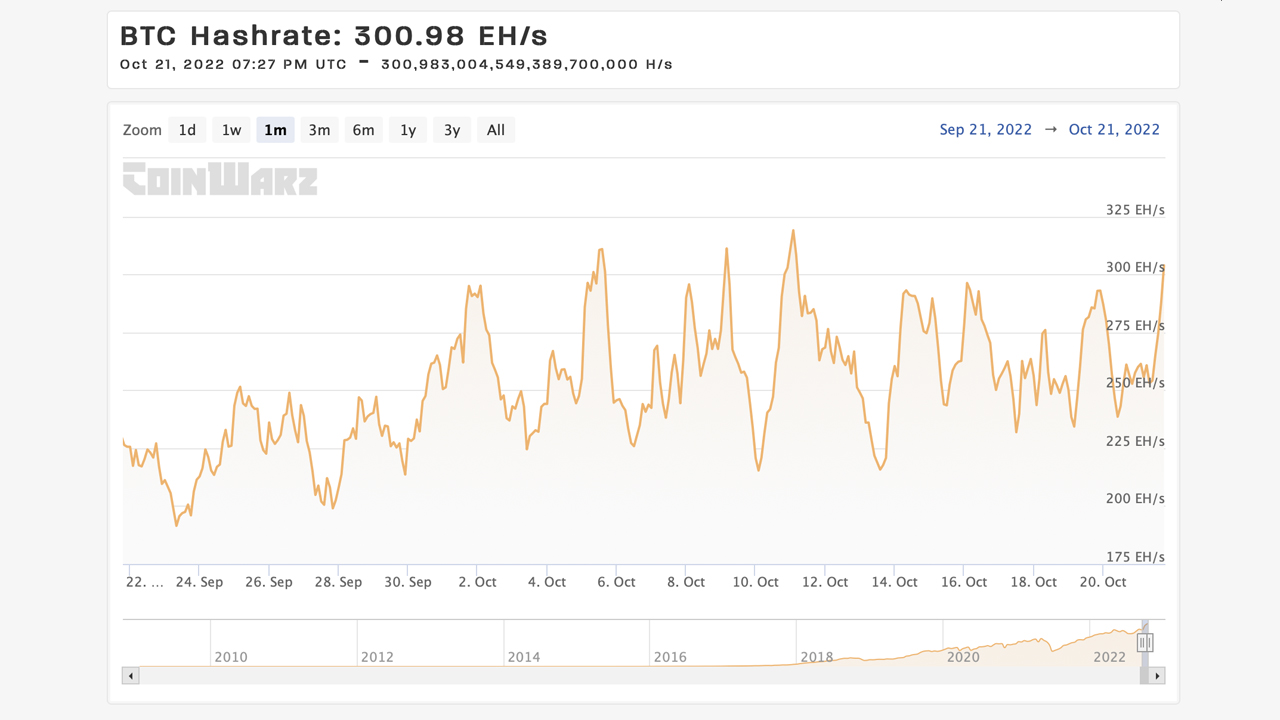

Whereas the problem ATH makes it much more difficult for bitcoin miners to discover a block subsidy, miners nonetheless have an excessive amount of hashrate devoted to the main crypto asset’s community safety. At this time, coinwarz.com statistics present BTC’s complete hashrate through the previous hour has been between 290 to 315 EH/s.

The metric is slightly below the October 11, complete hashrate ATH recorded at block peak 758,138. At the moment, the overall community hashrate reached a lifetime excessive at 325.11 EH/s.

Present block instances on Friday are lower than the ten-minute common as nicely, as a few data points present the present block instances at this time have been between 8:30 minutes to 9:35 minutes. Normally, when the two,016 blocks are discovered sooner than the ten-minute common, the retarget date is lower than two weeks.

When this pattern happens, the blockchain community’s mining problem will enhance with the intention to make it harder for miners to discover a BTC block. Satoshi created the system this fashion, so block instances would keep inside a constant ten-minute common.

On the time of writing, the problem is estimated to rise between 4.03% to 4.6% greater than the present 35.61 trillion. The anticipated share enhance would hike BTC’s mining problem as much as the 37 trillion vary.

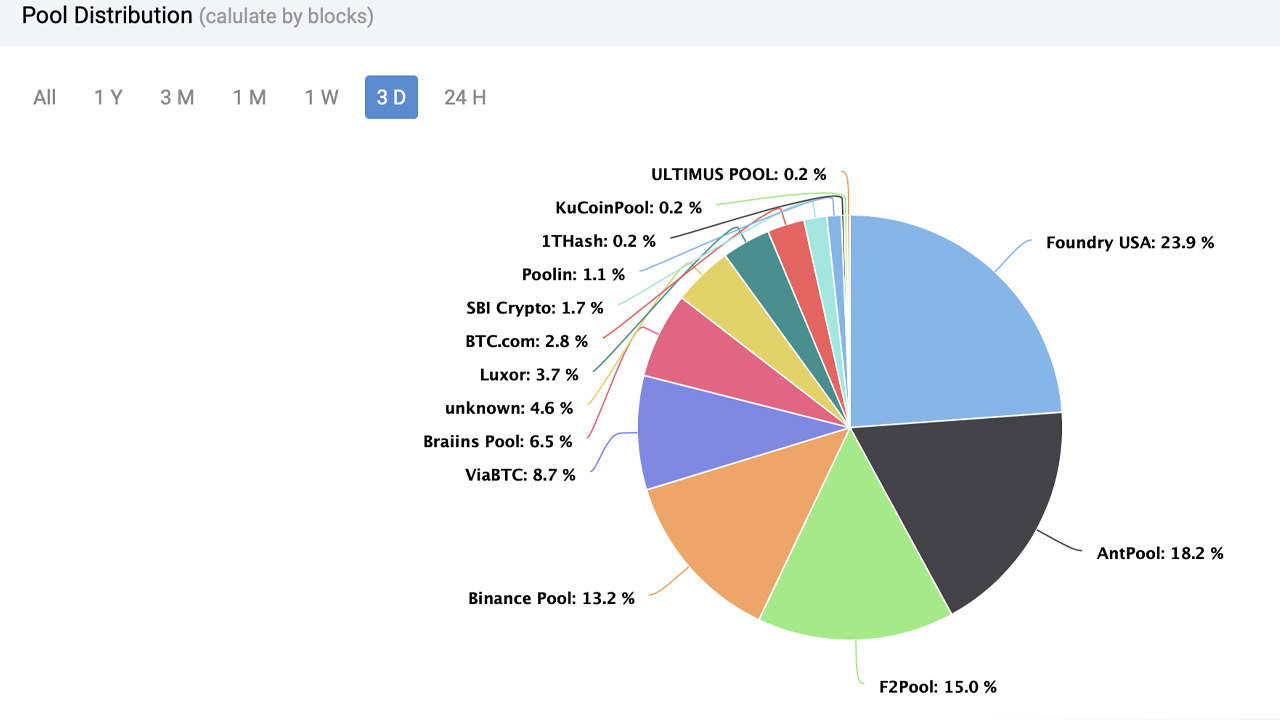

At present, the most important mining pool at this time, Foundry USA, has a median of 63.34 EH/s devoted to the BTC chain over the past three days. Foundry’s hashrate is round 23.86% of the overall community’s computational energy.

Under the highest BTC mining pool Foundry consists of miners like Antpool (48.37 EH/s), F2pool (39.73 EH/s), Binance Pool (35.13 EH/s), and Viabtc (23.03 EH/s) by way of the highest 5 hashers. There are at the moment 13 known mining pools dedicating hashrate to the BTC chain, and 12.09 EH/s, or 4.56% of the overall community is managed by unknown miners.

The file excessive hashrate comes at a time when a number of massive mining operations have been battling financial difficulties and bankruptcies. This week the funding financial institution DA Davison’s market analyst, Chris Brendler, downgraded the shares of Argo Blockchain (Nasdaq: ARBK) and Core Scientific (Nasdaq: CORZ) to impartial.

With the hashrate so excessive, an individual merely observing Bitcoin’s computational energy wouldn’t be capable of inform that some BTC miners are struggling. It could be the case, that whereas a handful of BTC mining operations have faltered, bigger operations are merely selecting up their slack, their ASICs, and amenities for discounted costs.

What do you concentrate on Bitcoin’s hashrate remaining excessive regardless of the obstacles it faces like the problem’s ATH and decrease bitcoin costs? Tell us your ideas about this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any harm or loss triggered or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.

[ad_2]

Source link