[ad_1]

When Sarah, a 29-year-old North American, give up her job within the movie trade and got here to review legislation in London, she hoped to place her life on a firmer monetary footing. Two years on, that aim appears additional away than ever.

Curiosity funds on a financial institution mortgage have gone up; she has misplaced weight having in the reduction of on groceries; and feels remoted as a result of going out prices an excessive amount of. A hovering vitality invoice has compelled her to maneuver out of her earlier flat-share.

And with earnings as a analysis assistant figuring out at £6.65 an hour, Sarah says it’s “unattainable to think about” planning for the longer term.

“I’m fixing the issue instantly in entrance of me, not constructing a long-term sport plan,” she says. “Each relationship and side of my life has been impacted . . . It’s as for those who’re climbing a staircase and also you don’t know if the following step goes to be there [or] for those who’re going to fall via.”

Sarah is one among numerous casualties of a worldwide price of dwelling disaster that’s forcing individuals around the globe to place their lives on maintain — forgoing social lives, scrapping home strikes and weddings, hesitating to begin a household or delaying retirement due to the monetary pressures brought on by excessive inflation.

From South Africa to Singapore, Kenya to New Zealand, and throughout Europe, the US and UK, a worldwide Monetary Instances’ survey that ran for per week in July drew tons of of responses from readers of all ages grappling with related issues: surging meals and gas costs, massive swings in trade charges, rising borrowing prices, and falls in asset costs eroding the worth of financial savings.

And whereas the financial hardship is painfully acute for individuals on decrease wages, even those that contemplate themselves financially comfy are discovering fastidiously laid plans are being upended.

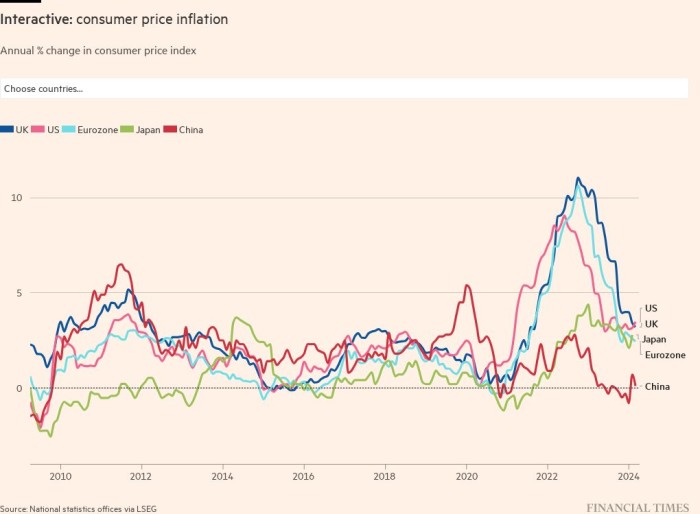

With inflation at its highest for many years in lots of nations, central banks around the globe are responding by elevating rates of interest at velocity. For thousands and thousands of individuals, this implies greater mortgage funds or increased rents as landlords move on their very own elevated prices. In the meantime, common wages are falling in actual phrases in most nations, prompting households to run down financial savings or reduce their spending.

A pause on luxurious

Many respondents mentioned thrift was now dictating their day-to-day habits: consuming much less meat; passing on small luxuries in favour of grocery store own-brand merchandise; giving up takeaway coffees and reduce flowers; minimising laundry, batch-cooking and taking the bus to keep away from filling gas tanks too typically.

“We now barely use the automobile. Our final journey was to Aldi, which speaks volumes about our life-style adjustments,” says Rosanna, a London-based civil servant now planning to job-hunt within the personal sector, as the prices of a house renovation challenge spiral.

However much more putting than these materials adjustments is the extent to which the disaster is isolating individuals from family and friends — simply because the easing of the pandemic had made socialising potential once more — as spending on leisure turns into tougher to justify.

About eight in 10 of the almost 500 respondents say they’d spend much less in eating places and pubs because of the price of dwelling disaster, whereas two-thirds had been contemplating scaling again on holidays and leisure.

“I’ve reduce down on going out and haven’t seen mates in months. It appears like a self-inflicted lockdown once more,” says Karl, a former financial institution worker in Rotherham, a city in northern England, now working in an Amazon warehouse on a 3rd of his former wage. Karl, who was made redundant close to the beginning of the pandemic, needs to return to monetary providers, however lately turned down an excellent alternative as a result of it might have price an excessive amount of to commute by automobile. “It’s a job I wish to do, however I can’t actually afford it,” he says.

Linda, a public sector employee in Leicester within the UK, has turned off her heating and restricted showers and laundry. “I don’t exit in my automobile until completely crucial, which is a blow as I stay alone,” she says. She has additionally postpone retirement regardless of reaching the state pension age.

“We’re in our late 30s, need youngsters and are very pissed off,” says Jessica, a nanny in Holyoke, Massachusetts, who had been home looking since mid-2020 along with her husband. As he was a freelancer, they had been struggling to safe a mortgage. Simply when he discovered a better-paid job, working remotely, rates of interest went up and the market turned. Now, they really feel caught in an condo with lead and asbestos. “We’re nervous to drop a 20 per cent down cost proper now, when costs and the financial system are so wonky, however we’re at an age the place placing life on maintain is devastating,” Jessica provides.

A disaster of two halves

The impression of the disaster is very unequal. Some individuals who answered the FT survey had been already making determined decisions — reducing meals, skimping on showers and utilizing a torch to keep away from turning the lights on.

Gurpreet, in west London, says she had obtained threats from bailiffs and was in search of a second job at weekends as “one job isn’t sufficient” to outlive. Drake Rose, a person in his 20s in San Diego, says he had stopped shopping for medication till he may repay debt that had constructed up whereas he was between jobs final yr, whereas a person in his 70s in Brazil is limiting his weight loss program to rice and beans.

On the different finish of the size had been individuals feeling little stress, both as a result of their incomes had been excessive sufficient to soak up the shock, or as a result of they’d obtained massive pay rises that matched inflation.

“My employer has elevated my wage materially, as they noticed me as a flight threat,” says Chris, a person in his 50s who had simply purchased a brand new electrical car and household home in Devon, within the south of England, whose pay is bolstered by non-executive roles. One other man whose wage had saved tempo with inflation — a thirtysomething dwelling in Mumbai — says he had even made financial savings, shopping for a automobile at a reduction whereas demand was low, and lowering his marriage ceremony price range when the pandemic was nonetheless limiting the dimensions of gatherings.

Others with a cushty monetary cushion had been turning into extra cost-conscious; forgoing luxuries, slightly than necessities — scrapping snowboarding holidays and season tickets, or the acquisition of a second dwelling. David, a New Zealander in his 70s, is promoting some surplus land and utilizing his boat much less, whereas a respondent in Singapore had switched his vacation plans from the Maldives to Vietnam.

About two in 10 respondents to the FT survey say they had been nonetheless prone to improve spending on dwelling enhancements, whereas 40 per cent say they would scale back it.

Larger earners had been additionally in a position to spend money on energy-saving tools that might repay over time. Nick, a Londoner on a six-figure wage, says he had “reset numerous settings in our high-tech dwelling”, whereas Mark, a person in his 50s within the Netherlands, had put in photo voltaic panels, window blinds, low-carbon heaters — whereas additionally taking his foot off the accelerator when he drove, to save lots of gas. Kipruto Chirchir, in Kenya, says his household is planning to switch a gas-guzzling SUV with two saloons.

In between these extremes, many individuals on salaries they’d often contemplate comfy had been additionally dealing with troublesome decisions.

“I earn £70,000 due to RMT [the transport workers’ union], however I’m nonetheless having to tighten the purse strings,” says Kim, a Londoner in her 20s, who has stopped ingesting alcohol and is car-sharing along with her accomplice, regardless of it being “a logistical nightmare for 2 shift staff”.

Kate, a lady based mostly in London, says: “We aren’t dwelling on the breadline . . . I perceive that we’re very privileged.” Nonetheless, she and her accomplice have delayed plans to maneuver out of a one-bedroom flat shared with their 3-year-old and have decreased their mortgage funds to cowl different payments. They’re additionally promoting on eBay for “a bit of additional cash we are able to use to do good issues”.

Share your expertise

How are you dealing with the price of dwelling disaster? Inform us your tales and ideas within the remark discipline on the backside of this story

Vitality shopper inflation is rising at an annual price of 52 per cent within the UK and 41 per cent within the eurozone, leaving appreciable much less cash out there for different items and providers, significantly leisure. Even within the US, the place the vitality disaster is much less pronounced, the price of vitality for customers rose 24 per cent in August.

“I believe we class ourselves as fairly firmly center class and didn’t suppose we’d be worrying about cash as a lot as we’re,” says Chris Cathcart, who lives in Hampshire within the UK. Having already delayed his marriage ceremony as soon as, due to Covid, he has now needed to defer it once more.

He and his girlfriend — who’re of their forties, with two youngsters — had discovered a venue solely barely past their price range, however an in a single day rise of their month-to-month vitality invoice from £90 to £270 made them put each marriage ceremony and vacation plans on maintain.

“We actually need to get married however we see it as a luxurious slightly than a necessity,” Chris says. “When you’d requested me two years in the past if we’d be having conversations about tips on how to make ends meet on the finish of the month then I wouldn’t have believed you but it surely’s what we’re doing and what a number of our mates are speaking about.”

‘Retirement is delayed’

Huge swings in trade charges have made some individuals’s funds much more of a lottery. “We earn in Polish zloty, however pay our mortgage in euros, so we have to pay extra now,” says Ewa, in Poland, who was reducing again on “each day small pleasures” and had placed on maintain her plans to purchase a much bigger home and automobile.

The greenback index, which tracks the US foreign money in opposition to six others, is up by a double-digit price for the reason that begin of the yr, including pressures on many different currencies each in superior and growing economies.

For others — particularly these counting on pension financial savings — falls in asset costs are the most important situation, inflicting them to delay retirement and even rejoin the workforce.

“At age 75, I’ve returned to full-time employment,” says Peter, a federal worker in Vienna, Virginia. Steve, in Wellington, New Zealand, had deliberate to retire this month, however now felt “like I’d be locking within the losses”.

“I actually don’t need to be the previous idiot pretending to be able to issues I’m not able to, however maybe I could have to,” says Patricia, a 69-year-old American contemplating a return to part-time work. Others in an analogous state of affairs had been taking over consulting work, educating English, or — within the case of 1 man in his 50s within the UK — switching from freelancing to full-time employment with a view to have a gentle revenue.

“Retirement is delayed. I’m driving a car with 255,000 miles on it that I’ve owned for 11 years,” says Michele, an American in her 60s who has reduce spending on flights, holidays and natural meals. “We have now modest means. We didn’t anticipate this sort of inflation,” provides her husband Joseph, who fears they may not afford each to retire.

In the meantime, youthful individuals are in despair of creating themselves, with a number of saying they’d now wait to purchase a property — and delay having youngsters consequently.

“I’ve moved again in with my mother and father as a result of I can’t afford to begin my finance profession in London . . . I don’t suppose I’ll ever be capable to afford to have youngsters or personal my own residence within the UK,” says one pupil, who hopes to save lots of sufficient to hire within the capital after graduating — however plans to hunt work overseas if not.

Nearly managing

One optimistic legacy of the pandemic — a better acceptance of distant working — has given some individuals flexibility that permits them to maintain prices down, whether or not by reducing out commuting, or by going to the workplace extra typically with a view to save on their heating invoice.

“Working from dwelling saved the day on commuting prices for me and my household — we now spend much less on gasoline monthly than in 2018,” says a person in Boulder, Colorado. In distinction, one man in his 20s, in Germany, was considering not solely utilizing the workplace to take pleasure in its heat, but in addition to bathe.

Most individuals say their money owed had been manageable, for now — though this survey was carried out in July earlier than the newest turbulence in UK markets drove up mortgage charges.

Nonetheless, many had been nervous about rising borrowing prices. Within the US, the common 30-year mortgage price isn’t far in need of 7 per cent, greater than double the speed final yr and the very best for the reason that 2008 disaster. Charges are the very best since 2016 within the eurozone and lenders are providing mortgage charges of about 6 per cent within the UK, up from a mean price of two.55 per cent in August.

A minority of respondents say they plan to fill the holes of their price range by working extra — whether or not by lengthening their hours, taking a second job or discovering a facet hustle. Gemma, an NHS employee in her 40s with a 70-mile each day automobile commute, says she was “placing stress on my teenagers to get jobs” so they may cowl a few of their very own prices.

However the extra frequent response was that individuals had been resigned to utilizing their financial savings or spending much less — together with on necessities.

“I’m too drained to work further . . . I’m simply reducing out, no holidays, not going out,” says Anita Henderson, one other NHS employee, who now expects to retire at 65, 5 years later than deliberate, as a result of she may not repay her mortgage as quick.

“I’ve no financial savings,” says one girl in her 60s engaged on the UK minimal wage, who has turned off her boiler and is consuming one meal a day. “When my cash runs out, I simply go with out.”

[ad_2]

Source link