[ad_1]

Realtors, mortgage brokers, and appraisers throughout the US are bracing for widespread job cuts as house gross sales plummet amid rising rates of interest.

For individuals who work in and across the housing market, the impact of aggressive strikes by the Federal Reserve to scale back inflation has been swift and extreme.

“It went from feast to famine, from everyone shopping for to turtle sluggish,” mentioned Linda McCoy, board president of the Nationwide Affiliation of Mortgage Brokers.

Realtors, mortgage brokers, appraisers, and development teams say they’ve misplaced as a lot as 80 per cent of their income because the Fed began elevating rates in March. Charges for a 30-year mounted mortgage — at 6.66 per cent — have practically doubled since and are actually at their highest stage since 2008.

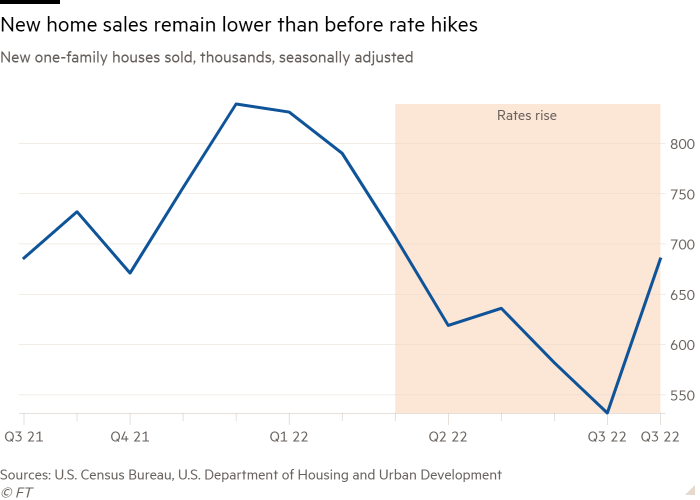

Dwelling gross sales shortly plunged as larger borrowing prices and recession fears discouraged patrons. Almost 20 per cent fewer properties have been bought this August than throughout the identical month final yr, in response to the Nationwide Affiliation of Realtors. For realtors and mortgage brokers, who largely work on fee, the altering market has decimated their livelihoods and pushed others out of the sector altogether.

“There’s going to be a significant shakeout,” mentioned Ken Johnson, an actual property economist at Florida Atlantic College who can also be a former dealer. “There are roughly 1.5mn realtors, however that quantity will likely be down 20 per cent inside 24 months. And people aren’t the one members of the actual property business which are very depending on the amount of transactions. There are these tertiary jobs just like the appraisers, the mortgage lenders, all the way in which right down to termite inspectors.”

Mortgage lenders have been among the many first to get rid of workers. In April, Wells Fargo, which originates extra mortgages than every other US financial institution, laid off practically 200 mortgage processors and their managers, blaming “cyclical adjustments within the broader home-lending setting”. USAA, Citigroup and JPMorgan Chase later introduced cuts to their very own house lending workforces.

Different impartial lenders, together with Sprout Mortgage and First Warranty Mortgage Corp, have gone out of enterprise.

Some brokers did nearly a 3rd of their enterprise refinancing current mortgages as charges hovered close to report lows in recent times, however functions for refinancing fell 80 per cent over the previous yr, in response to the Mortgage Bankers Affiliation. New mortgage functions dropped 29 per cent in the identical interval.

“The best way these charges have risen so quick is sort of catastrophic to the business,” McCoy mentioned.

A report 1.5mn Individuals labored as actual property brokers through the peak of the market final yr. Getting an actual property licence is simpler than coming into different industries with excessive incomes potential, requiring solely a highschool diploma and three to 6 months of coaching main as much as an examination. Hundreds of recent staff rushed in as house costs accelerated through the Covid pandemic, hoping to reap the benefits of versatile working hours and sky-high earnings. Some 156,000 folks joined the Nationwide Affiliation of Realtors in 2020 and 2021 alone. That’s 60 per cent greater than within the two years earlier than.

“That progress was a lot stronger than the house gross sales alternatives that have been out there,” mentioned Lawrence Yun, the chief economist for the Nationwide Affiliation of Realtors. “The fact is that not everybody’s going to outlive.”

In June, Redfin and Compass laid off a whole lot of workers. Redfin chief govt Glenn Kelman instructed workers that he feared “years, not months, of fewer house gross sales”. Compass mentioned its lay-offs have been “because of the clear indicators of slowing financial progress”, earlier than eliminating extra jobs final month.

Although lay-off charges tracked by the labour division confirmed that the variety of actual property staff whose jobs have been eradicated are little modified at 16,000 in August, Johnson mentioned that almost all brokers work as impartial contractors and are usually not counted in jobs knowledge. Many will pivot their enterprise fashions or tackle second jobs to complement their earnings, he predicted.

Shane Skelly, an actual property agent and residential flipper in San Diego, “froze” his enterprise’s home flipping arm in June as potential patrons disappeared. His firm, Left Coast Realtors, is now specializing in facilitating renovations for previous purchasers.

“It wasn’t excessive to start with, during the last couple of months it’s actually accelerated,” Skelly mentioned. “It’s slightly bit extra vital of a correction than I assumed it was going to be.”

Mike Pappas, the chief govt of Florida-based brokerage The Keyes Firm, mentioned he’s contemplating scaling again overhead prices on workplaces and advertising and marketing within the hopes of avoiding having to put off any of his agency’s 3,300 brokers.

“We now have to reply dramatically to regulate to the brand new regular,” Pappas mentioned.

However for a lot of, falling house gross sales may push them out of enterprise solely, mentioned Johnson at Florida Atlantic College.

“Most which are in enterprise at the moment have by no means bought in a 7 per cent 30-year mortgage charge setting,” he mentioned. “That mortgage charge obtained too excessive and I feel lots of people are wanting round saying: ‘you recognize, what’s subsequent?’”

[ad_2]

Source link