[ad_1]

This text is an on-site model of our Commerce Secrets and techniques publication. Join here to get the publication despatched straight to your inbox each Monday

Hey, and welcome to Commerce Secrets and techniques. Keep in mind the worldwide provide chain disaster? What was that all about? Clearly it’s a hostage to fortune to say this, however the snarl-ups in world transport and logistics which have been exercising us all since late 2020 are easing very quickly. Ever alert to the darkish cloud inside any silver lining, although, I counsel we watch out what we want for. Charted waters appears on the gloomy outlook forward of the World Financial institution and IMF’s annual conferences this week.

Get in contact. E-mail me at alan.beattie@ft.com

Darkish days within the financial ecosystem

First, a slight diversion. We shouldn’t actually name them “provide chains”. It’s a extra correct reflection of the versatile, multi-stranded nature of the worldwide items buying and selling system to make use of the much less snappy (therefore my not utilizing it within the headline) “provide networks” or the even unsnappier “provide ecosystems”. A series is ineffective as quickly as its weakest hyperlink breaks, however networks and ecosystems discover methods to compensate when one department or node is ruptured. The enormously vital context for the logistics disaster is that the extraordinary enhance in transport delays and freight charges since late 2020 didn’t truly cease a fairly wholesome restoration in world commerce and financial development after the preliminary blow of the pandemic.

That pedantic train in terminological exactitude out of the way in which, let’s get on with the present. It’s now clear the crunch is quickly uncrunching. Freight charges and ready occasions at ports are dropping quickly. The US logistics managers’ index exhibits spare transportation capability taking pictures up and costs falling. The New York Fed measure of world provide chain stress, which weights collectively supply occasions, backlogs and inventories, is again right down to ranges final seen on the finish of 2020.

Inflation stays excessive, however the Institute of Worldwide Finance, whose chart of supply occasions and prices is under, calculates that it’s now pushed by the vitality shock from the Ukraine battle fairly than the price of provide disruption.

As provide ecosystems malfunctioned final yr, explanations fell into two fundamental camps. I used to be in Staff Transitory Demand Effect, which argued it mirrored primarily the large resurgence of consumption and notably client durables (e-bikes fairly than meals supply) after lockdowns lifted, placing stress notably on the inefficient ports on the US West Coast. The opposite gang was Staff Deep-Seated Provide Issues, who have been all in regards to the disaster in globalisation and geopolitics and fragile provide networks and underpriced dangers of offshoring and what have you ever. A little bit of a simplification, however that’s how the perimeters lined up.

Properly, to not declare final victory, however the demand clarification is definitely the more than likely for what’s altering proper now. There’s loads of gloom a few world recession forward, which if historical past is a information will hit items commerce notably onerous. Against this the provision aspect hasn’t notably improved: geopolitics and certainty in regards to the robustness of provide networks isn’t all rainbows and kittens. And I can’t discover anybody who thinks the Port of Los Angeles and related trucking companies have all of a sudden perked up.

Jennifer Bisceglie, chief govt of the provision chain consultancy Interos, says it’s about shopping for behaviour. “First, customers don’t want the identical onerous items: they’re again to doing journey, they’re again to purchasing companies. The second is there’s a lot uncertainty within the financial system and there’s inflation. The third is that corporations are sitting on stock and so there isn’t the identical throughput.”

As for the concept that the discount in congestion displays a sudden enhance in capability or effectivity, Bisceglie says: “If after three years you’re ready for an enormous bang change in provide chains primarily based on the pandemic, I believe it’s already occurred.”

Not all the information factors line up. Flexport, the freight forwarding firm that screens these items, factors out that relative client durables demand remains to be excessive.

However these figures are from previous months. Ahead-looking indicators, particularly in container transport, are trying fairly grim: orders are dropping and the variety of “clean sailings”, the place carriers cancel journeys, is rising. The World Trade Organization is forecasting an enormous slowdown in commerce subsequent yr.

Phil Levy, chief economist at Flexport, posits there’s a non-linear relationship: “It’s fairly potential you will get some massive impacts on provide chain congestion with a comparatively small discount in volumes, the identical means {that a} freeway that’s 90 per cent full could be transferring fairly nicely however one which’s 99 per cent full is at gridlock.”

Now, after all I’ve barely caricatured and given a stark either-or framing of the totally different explanations, notably for expository comfort and partly to make myself appear cleverer. Clearly there are some supply-side issues — the Covid-related port and trucking shutdowns in China being one among them — which made the demand-driven congestion and transport prices worse and which have considerably been resolved. Adjustments aren’t the identical as ranges: if what we’re seeing is a severe downturn, there would possibly nonetheless be some congestion issues when demand returns to long-term development. There may nicely even be some massive structural modifications happening in patterns of sourcing and provide networks which have but to work themselves out, notably because the geopolitical scenario can all the time get quite a bit worse.

Nevertheless, should you’re searching for an evidence for the previous couple of years of excessive prices and choking congestion, the demand one is more than likely. It’s a disgrace it wants the prospect of an enormous slowdown to show it — I’d fairly have development with snarled-up ports than a recession with plain crusing — however that’s the way in which issues are.

In addition to this article, I write a Commerce Secrets and techniques column for FT.com each Wednesday. Click on right here to learn the most recent, and go to ft.com/trade-secrets to see all my columns and former newsletters too.

Charted waters

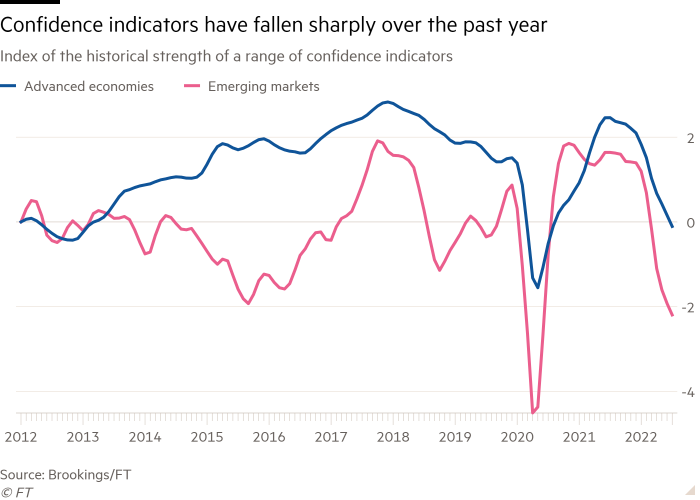

To cite the identify of one other FT publication, we reside in disrupted occasions. The newest affirmation of that is the twice-yearly Brookings-FT Tracking Index for Global economic recovery (Tiger), which confirmed momentum on the planet financial system stalling and several other international locations both on the point of recession or already plunged into one.

The information have been launched as world monetary officers gathered in Washington for the World Financial institution and IMF’s annual conferences this week. Each our bodies are anticipated to publish experiences warning that the world financial system is on the point of recession.

Any vibrant information? Sure, if you’re India. It’s the world’s solely massive financial system described as a “vibrant spot” within the Tiger analysis, with robust indicators pointing to strong development this yr and subsequent. (Jonathan Moules)

Commerce hyperlinks

The EU is constant to complain about electrical car tax credit within the US Inflation Discount Act, which favour North American suppliers.

China’s semiconductor trade is bracing itself for a repeat of the ache the US inflicted on Huawei by imposing far-reaching export controls.

Henry Farrell and Abraham Newman, two of the nice gurus of financial interdependence, say that weak hyperlinks in finance and provide chains are easily weaponised.

In case you’re within the politically charged saga of waivers for IP safety for Covid vaccines and coverings within the WTO, the Geneva Well being Recordsdata information service has collected all its great in-depth reporting.

The Zambian sovereign debt disaster is setting international precedents on debt restructuring, as is Sri Lanka’s.

Commerce Secrets and techniques is edited by Jonathan Moules

[ad_2]

Source link