[ad_1]

The strong tempo of US jobs progress cooled in September however the unemployment charge unexpectedly dropped, firming expectations that the Federal Reserve will elevate rates of interest by one other 0.75 share factors at its subsequent assembly in November.

The world’s largest economy added 263,000 positions final month, in line with the Bureau of Labor Statistics, fewer than the 315,000 positions created in August and effectively under July’s 537,000 enhance. Up to now in 2022, month-to-month jobs progress is averaging 420,000, down from the 562,000 common month-to-month tempo in 2021.

Regardless of the slower tempo of progress, the unemployment charge edged again right down to its pre-pandemic low of three.5 per cent because the share of People both employed or looking for a job declined barely.

“The story is {that a} 0.75 share level hike in November is probably going,” mentioned Tiffany Wilding, North America economist at Pimco. “The Fed must proceed to tighten.”

Officers on the US central financial institution are actively discussing whether or not a fourth-consecutive jumbo charge rise is critical subsequent month or if they’ll doubtlessly downshift to elevating charges in half-point increments. Up to now this yr, the Fed has lifted its benchmark coverage charge from near-zero to a variety of three per cent to three.25 per cent.

The talk rests on how resilient the US economic system continues to be and whether or not inflation is starting to development again to the Fed’s 2 per cent goal.

Friday’s report underscored that the labour market stays fairly robust, regardless of current indicators employers are starting to reduce hiring.

Earlier this week, new knowledge confirmed corporations slashed more than 1mn job openings in August — one of many sharpest month-to-month declines in twenty years. That pushed the ratio of job vacancies to unemployed folks right down to 1.7 from 2.

Employees are nonetheless quitting at a excessive charge, nevertheless, suggesting that labour provide and demand are nonetheless out of stability.

Merchants in fed funds futures contracts on Friday priced within the odds of a 0.75 share level charge rise subsequent month at 82 per cent, in line with CME Group, up from 75 per cent previous to the most recent jobs report.

The S&P 500 slid 2.2 per cent decrease in early buying and selling on Wall Road on Friday, having been about flat forward of the info launch. The yield on the two-year US Treasury, which is delicate to adjustments in coverage expectations, was up 0.06 share factors to 4.31 per cent.

In line with Alex Veroude, chief funding officer for fastened revenue at Perception Funding, Friday’s knowledge additional solidifies {that a} Fed “pivot” will not be coming anytime quickly.

Officers this week have been adamant that they’re not yet considering any kind of pause or scaling again of their tightening plans, whilst indicators of stress start to emerge within the monetary system and the worldwide financial outlook sours.

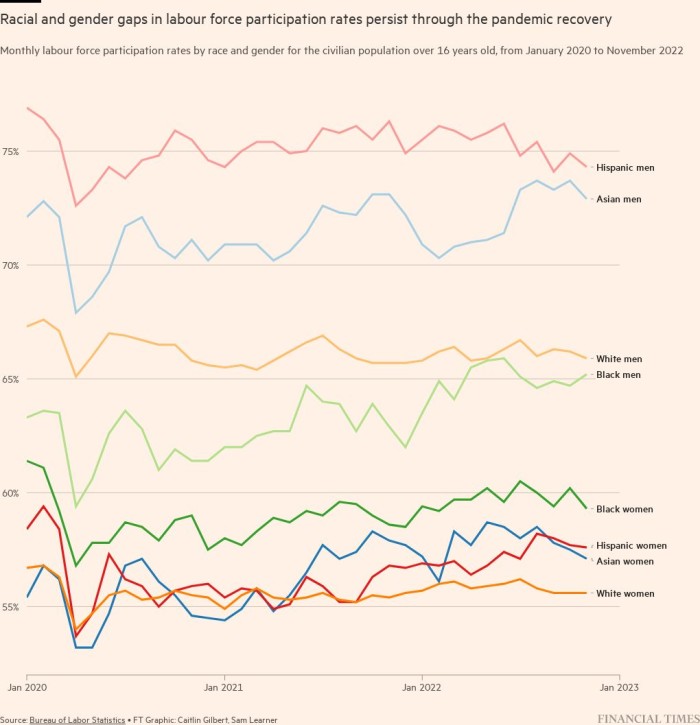

Worryingly, the labour market remains to be hobbled by a scarcity of staff. As of September, the so-called labour pressure participation charge nonetheless remained under its pre-pandemic degree, at 62.3 per cent. The general labour pressure additionally shrank by 57,000 folks.

Main the roles positive factors was the leisure and hospitality trade, which added 83,000 positions, adopted by a 60,000 enhance in healthcare employment. The development and manufacturing sectors continued so as to add jobs as effectively, whereas the variety of transportation positions declined.

Common hourly earnings in September elevated on the identical 0.3 per cent charge as within the earlier interval, translating to an annual leap of 5 per cent.

The persistently tight labour market — and the wage positive factors which have adopted swimsuit as corporations attempt to appeal to new hires and retain previous ones — is a high concern for the Fed, which is actively making an attempt to restrain demand and cut back value pressures via supersized rate of interest will increase.

By the top of the yr, most officers forecast the federal funds charge to hover between 4.25 per cent and 4.5 per cent, with additional charge rises in early 2023. The benchmark coverage charge is anticipated to peak simply above 4.5 per cent.

Officers challenge that their efforts to tame the worst inflation in 4 many years would require not solely a sustained interval of “below-trend” progress, but additionally job losses. A recession cannot be ruled out, Fed chair Jay Powell just lately warned.

In line with the latest projections revealed by the Fed final month, the median forecast amongst policymakers for the unemployment charge reveals it rising to only 3.8 per cent by the top of the yr earlier than leaping in 2023 to 4.4 per cent and staying at that degree till 2025.

Officers have maintained that inflation might be tamed with no extra substantive rise in unemployment, not least as a result of employers could also be hesitant to chop their workforces given the magnitude of the labour scarcity for the reason that onset of the pandemic.

[ad_2]

Source link