[ad_1]

This text is an on-site model of our Unhedged publication. Join here to get the publication despatched straight to your inbox each weekday

Good morning. All of us have our petty dignities. Ours is refusal to jot down about Elon and Twitter. However there was a lot going available in the market’s much less absurd corners, together with a job openings report that inspired shares, already primed to rise, to rise sooner nonetheless. Is that this rally a repeat of August’s false daybreak? Tell us what you assume: robert.armstrong@ft.com and ethan.wu@ft.com.

Cooling within the jobs market

Keep in mind Fed governor Christopher Waller’s theory of a soft landing?

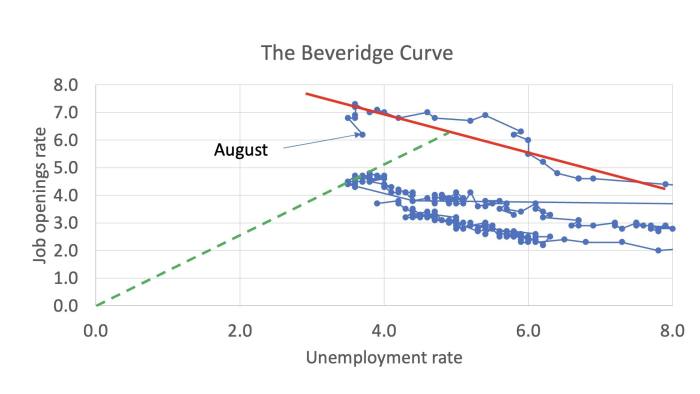

Right here’s a refresher. Waller argues that the pandemic has modified the labour market. Particularly, job vacancies — a measure of labour demand — have been a lot increased relative to unemployment. This creates the likelihood that tighter coverage might decrease vacancies — that’s, labour demand — with out elevating unemployment. Wage development, and subsequently inflation, would fall too.

The graph under from Waller (which we’ve proven you earlier than) plots the emptiness charge towards unemployment, the place every dot represents one month. The shift he envisions would monitor the inexperienced arrow under, snapping again to the pre-pandemic regime:

We’ve been sceptical of Waller’s concept. It’s exhausting for us to see why tighter financial coverage — which works by indiscriminately whacking demand — would narrowly decrease job openings with out additionally dragging up unemployment. Plus, as Skanda Amarnath of Make use of America has noted, the vacancies knowledge simply may not be that dependable. It’s, in spite of everything, cheaper and simpler than ever to submit a job itemizing on-line.

Yesterday introduced knowledge that made Waller look prescient. Job vacancies within the newest Jolts survey fell exhausting, with 10 per cent fewer openings in August than July. Add this to anecdata on hiring freezes and lay-offs in some sectors, and a few are already recognizing a cooling labour market. Paul Krugman of the New York Occasions tweeted out this up to date model of Waller’s vacancies vs unemployment chart (referred to as the Beveridge curve), with the newest knowledge flagged:

Krugman writes:

Two extra months like that (unlikely, however nonetheless) would restore the previous [relationship between vacancies to unemployment]. This implies that the disruptions within the labour market could also be therapeutic.

Sure, one month’s knowledge, don’t rely your chickens and many others. However this was the most effective financial information I’ve seen for a very long time.

This might affect Fed decision-making. Ian Shepherdson at Pantheon Macro referred to as it a “potential Fed game-changer”, arguing:

The frequency with which Mr Powell refers to this quantity signifies that it’s taken very significantly inside the Fed . . . two extra Jolts stories will probably be launched earlier than the December [Fed meeting], and in the event that they appear to be August’s the Fed won’t be mountaineering by 50bp or extra on the remaining assembly of the yr.

Possibly. We’d learn the openings numbers extra cautiously. Contemplate the large image. Inflation is the actual goal right here. It’s edging down however nonetheless sizzling, and the Fed has set a excessive bar (“clear and convincing proof”) for letting up on charge will increase. And even simply taking a look at labour market indicators, normalisation is a methods off. The quits charge, a extra dependable measure of tightness than job openings, remains to be effectively above pre-pandemic ranges. On the tempo quits have fallen from their December 2021 peak, it might take 11 months to normalise:

From wage development to hours worked, practically all labour market charts appear to be the one above: off their peaks, however removed from regular. Monetary markets care mainly about change on the margin, however the Fed has made clear that it’s going to wait till the development is clear. A lot nonetheless must go proper. (Ethan Wu)

China’s property disaster, world disengagement and the return to low inflation

Everybody ought to learn the big read on the Chinese language property disaster by our colleagues James Kynge, Solar Yu and Thomas Hale. Right here’s the core argument:

-

China’s introduction of the “three crimson strains” debt limits in 2020 left builders with out the capital to finish pre-sold housing tasks. These “hung” tasks sparked a rout within the bubbly property market.

-

Broke or near-broke property builders, not capable of ponder new tasks, have purchased a lot much less land from native governments.

-

This has left native authorities financing autos (LGFVs) in need of funds and liable to default. LGFVs are the primary supply of funds for infrastructure tasks, from roads to energy vegetation, and the LGFV debt inventory is equal to half of China’s annual GDP. Yikes.

-

The underlying drawback? Falling returns on debt-financed personal and public tasks. The killer quote, from a US investor: “The LGFVs took on debt at round 6 per cent and get returns on fairness of perhaps 1 per cent . . . Most of them depend on subsidies from native governments. However now that native authorities income from land gross sales are down, lots of the subsidies are simply stopping.”

-

The federal government has the means to cease this “sluggish movement disaster” from dashing up. However the debt-driven development mannequin of current many years seems to be defunct.

-

This has world implications: “Between 2013 and 2018, in keeping with a examine by the IMF, China contributed some 28 per cent of GDP development worldwide — greater than twice the share of the US.” A contribution close to that stage appears unlikely sooner or later.

This remaining level matches right into a debate we’ve aired within the house a number of instances (most just lately last week). Is the present financial second an aberrant incident inside the low inflation regime of current many years, or an inflection level and a style of a extra inflationary world to return? If China’s development section is over, that helps the previous place. A slow-growing China must be deflationary.

Some extent that appears essential to Unhedged is that change being compelled on China by the property disaster is bolstered by deliberate modifications in Chinese language coverage — by the plan to create of what Kynge has referred to as “fortress China”.

On this context, it’s value studying the newest position paper from the European Chamber of Commerce in China. It opens as follows: “Though Europe and China already sit at reverse ends of a shared continent, it appears they’re drifting additional and additional aside.” A litany of complaints follows: laws protecting overseas varieties have gotten extra stringent and fewer predictable; obstacles to new entrants to the China market are rising; efforts to reform China’s state-owned entities, which dominate key industries, have stalled.

The chamber’s report doesn’t title particular firms. However this summer season, for instance, the top of carmaker Stellantis (the product of the Fiat Chrysler/Peugeot merger) warned “there may be rising political interference in the way in which we do enterprise as a western firm in China”, after Stellantis dissolved a producing three way partnership with a Chinese language associate.

Beijing’s zero-Covid insurance policies make all this worse, however the chamber sees these insurance policies as extension of, slightly than an aberration from, enterprise coverage usually. Ideology is trumping financial system. The reforms and opening up of the Nineteen Nineties are a factor of the previous. Because of this, the chamber argues, European firms that had been as soon as intent on increasing within the nation are more and more targeted on assembly the challenges dealing with their current Chinese language operations. European funding in China is declining, and is now dominated by just some giant firms. Companies are actively exploring diversification of provide chains away from China.

The image painted by the chamber’s report issues for the trajectory of world development. It means that not solely will China battle to develop rapidly because it transitions away from the borrow-and-build mannequin, however that development is not a high precedence of China’s policymakers — not less than not development of the outward-facing type that the remainder of the world has gotten accustomed to.

One good learn

How in tarnation do you archive the internet? Seems it’s fairly exhausting.

[ad_2]

Source link