[ad_1]

Analysts have downgraded their 2023 financial development forecasts for the UK within the wake of the “mini-Price range”, with many warning of little enchancment within the medium time period.

Chancellor Kwasi Kwarteng mentioned final month that the federal government wished to “flip the vicious cycle of stagnation right into a virtuous cycle of development”.

However many analysts assume the federal government’s fiscal bundle, which despatched gilts and sterling tumbling, has piled a borrowing prices disaster on high of an present dwelling prices disaster.

The economic system is predicted to contract 0.3 per cent subsequent yr, based on Consensus Economics based mostly on a median of main forecasts — a major fall from the 0.1 per cent enlargement forecast in August.

Gaurav Ganguly, senior director of financial analysis at Moody’s Analytics, mentioned the federal government’s “latest actions had made stagflation and a deep recession nearly inevitable”.

On the similar time, many economists see no enchancment within the medium-term outlook, with predicted annual common development mounted at 1.5 per cent, properly under the chancellor’s goal of two.5 per cent.

In actual fact, Ganguly mentioned there was a threat that medium-term development “traits decrease” as questions lingered “across the stability of the pound and the desirability of the UK as an funding location”.

Kallum Pickering, senior economist at Berenberg Financial institution, mentioned extra info on insurance policies over deregulation was wanted to make a full evaluation.

Nevertheless, he famous that with out some supply-side reform the tax cuts “can not increase UK potential development sooner or later”. He anticipated a 1.5 per cent contraction in financial development in 2023, reflecting a extra pessimistic view than the consensus.

He added that whereas tax cuts would assist demand, the “confidence shock” and “important tightening in monetary circumstances” that adopted the federal government’s bulletins “will overwhelm any of their near-term results”.

The mini-Price range “is a transparent coverage failure, and due to this fact the economic system pays a value for that”, Pickering mentioned.

Economists from Berenberg, UBS, Goldman Sachs and HSBC are forecasting three quarters of financial contraction from the three months to September, adopted by both weak development or the economic system flatlining till the tip of subsequent yr.

That is regardless of the package of state energy support, which can freeze common family vitality payments at £2,500 a yr for 2 years.

Prime minister Liz Truss’s cancellation of the tax rate cut for the very best earners, which accounts for £2bn within the £45bn bundle of cuts, was solely “a small a part of the equation”, mentioned Susannah Streeter, senior funding and markets analyst at asset supervisor Hargreaves Lansdown.

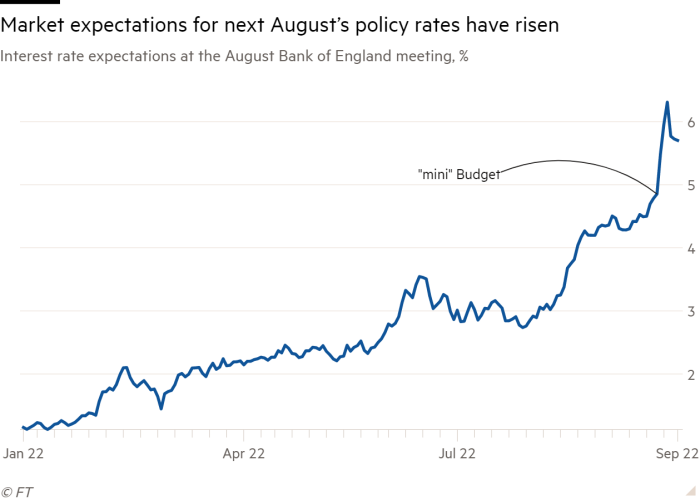

Markets are nonetheless pricing in that the Financial institution of England will increase rates of interest to above 5.5 per cent by August 2023. It is a sharp improve on the present 2.25 per cent price, and greater than a full proportion level above what was beforehand anticipated.

Ross Walker, chief UK economist at NatWest Markets, warned that the hikes within the financial institution price had barely fed by way of to the true economic system. “This hit is coming and its power will improve,” he mentioned.

Even when persons are not instantly hit by rising charges they’ll in all probability be apprehensive about what their mortgage funds might be in six months’ time or a yr, mentioned Martin Beck, chief financial adviser on the consultancy EY Merchandise Membership. This may trigger households to “spend much less and save extra”.

Some analysts predict present circumstances will result in a recession on the finish of subsequent yr, fairly than this yr.

Ganguly mentioned the constructive results of the tax cuts “can have pale by this time subsequent yr” with the UK more likely to slip right into a deep recession lasting a number of quarters.

Streeter, famous that buyers face “extreme cost-of-living headwinds” as a result of greater value of imports caused by the weaker pound.

These worries, she mentioned, can be compounded by fears about rising housing prices, at a time when many would already be grappling with greater vitality payments; “purse-tightening will proceed”, she mentioned.

[ad_2]

Source link